Navigating Currency Limits: A Guide To Carrying Money Abroad For Indian Travelers

Navigating Currency Limits: A Guide to Carrying Money Abroad for Indian Travelers

Related Articles: Navigating Currency Limits: A Guide to Carrying Money Abroad for Indian Travelers

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Currency Limits: A Guide to Carrying Money Abroad for Indian Travelers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Currency Limits: A Guide to Carrying Money Abroad for Indian Travelers

Traveling abroad is an exciting experience, but it’s essential to understand the regulations surrounding currency exchange and limits on carrying money across international borders. For Indian citizens, the Reserve Bank of India (RBI) has established guidelines to ensure compliance with international financial regulations and prevent money laundering. This article provides a comprehensive overview of the permissible limits for carrying Indian Rupees (INR) and foreign currencies while traveling outside India.

Understanding the Regulations:

The RBI’s Foreign Exchange Management Act (FEMA) governs the movement of foreign currency in and out of India. It specifies the limits on the amount of money that can be carried abroad, both in INR and foreign currencies. These limits are designed to prevent illegal transactions and maintain financial stability.

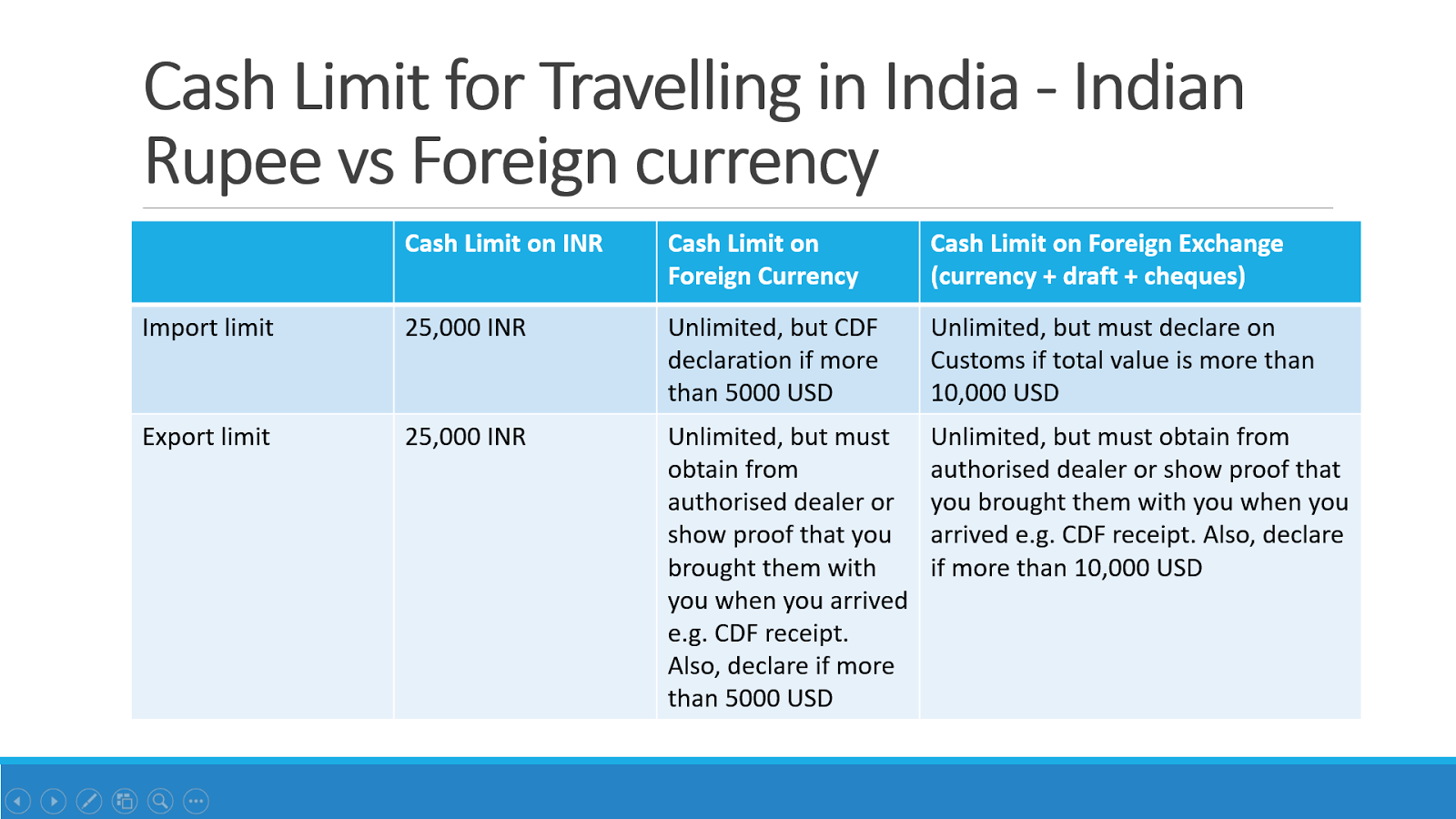

Carrying Indian Rupees (INR) Abroad:

- No specific limit: There is no fixed limit on the amount of INR that can be carried abroad. However, it’s crucial to declare the amount exceeding INR 25,000 to the Customs authorities at the airport.

- Declaration and documentation: When carrying INR exceeding INR 25,000, travelers must fill out a Currency Declaration Form at the airport. This form requires details about the source and purpose of the funds.

- Currency conversion: It’s generally advisable to convert a portion of INR into the currency of the destination country before departure. This helps avoid high conversion fees at the airport or within the destination country.

Carrying Foreign Currency Abroad:

- Permissible limit: The maximum amount of foreign currency that can be carried abroad is USD 25,000 or its equivalent in other currencies.

- Declaration requirement: Travelers must declare the amount of foreign currency exceeding USD 10,000 or its equivalent to the Customs authorities at the airport.

- Documentation: When carrying foreign currency exceeding the declaration limit, travelers must provide supporting documentation, such as bank statements or exchange receipts, to prove the source of the funds.

Additional Considerations:

- Purpose of travel: The permissible limits may vary depending on the purpose of travel, such as tourism, business, or medical treatment.

- Travel duration: For extended trips, it may be necessary to carry a larger amount of foreign currency.

- Age restrictions: There may be separate regulations for minors traveling abroad.

Benefits of Adhering to Regulations:

- Smooth travel experience: Compliance with currency regulations ensures a hassle-free travel experience, preventing delays and complications at the airport.

- Legal compliance: Adhering to the rules avoids penalties and legal repercussions.

- Financial security: Declaring the amount of currency carried helps protect against loss or theft.

FAQs:

Q1: Can I carry more than USD 25,000 in foreign currency?

A: No, the maximum permissible limit for carrying foreign currency abroad is USD 25,000 or its equivalent in other currencies.

Q2: Do I need to declare the amount of INR I am carrying abroad?

A: Yes, you must declare the amount of INR exceeding INR 25,000 to the Customs authorities at the airport.

Q3: What happens if I carry more foreign currency than the permissible limit?

A: You may face penalties and legal consequences, including seizure of the excess amount.

Q4: Can I carry foreign currency in cash or traveler’s checks?

A: Both cash and traveler’s checks are permitted, but it’s recommended to carry a mix of both for added security.

Q5: What documents do I need to provide for declaring foreign currency?

A: You may need to provide bank statements, exchange receipts, or other documents to prove the source of the funds.

Tips for Managing Your Currency:

- Plan ahead: Research the currency exchange rates and plan your budget before departure.

- Use a debit or credit card: Carrying a debit or credit card is a convenient and secure way to access funds while traveling.

- Exchange currency at authorized locations: Use authorized banks or money changers for currency exchange to avoid fraudulent transactions.

- Keep receipts: Always keep receipts for all currency exchange transactions.

- Check with your bank: Inquire about any fees associated with using your debit or credit card abroad.

Conclusion:

Understanding the regulations regarding currency limits is crucial for Indian travelers to ensure a smooth and compliant journey. By adhering to the guidelines set by the RBI, travelers can avoid potential complications and legal issues. It’s recommended to research the current regulations and contact relevant authorities for any specific queries. With proper planning and awareness, travelers can confidently navigate currency exchange and enjoy their international travel experience.

.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating Currency Limits: A Guide to Carrying Money Abroad for Indian Travelers. We appreciate your attention to our article. See you in our next article!