Navigating Currency Regulations: Understanding Dollar Limits For Travel To India

Navigating Currency Regulations: Understanding Dollar Limits for Travel to India

Related Articles: Navigating Currency Regulations: Understanding Dollar Limits for Travel to India

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Currency Regulations: Understanding Dollar Limits for Travel to India. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Currency Regulations: Understanding Dollar Limits for Travel to India

Traveling to India can be an enriching experience, but navigating currency regulations is crucial. While there are no explicit limits on the amount of US dollars individuals can physically carry into India, the Reserve Bank of India (RBI) has established guidelines regarding the declaration and exchange of foreign currency, ensuring transparency and compliance. This article provides a comprehensive overview of these regulations, offering clarity and guidance for travelers.

Understanding the Regulations:

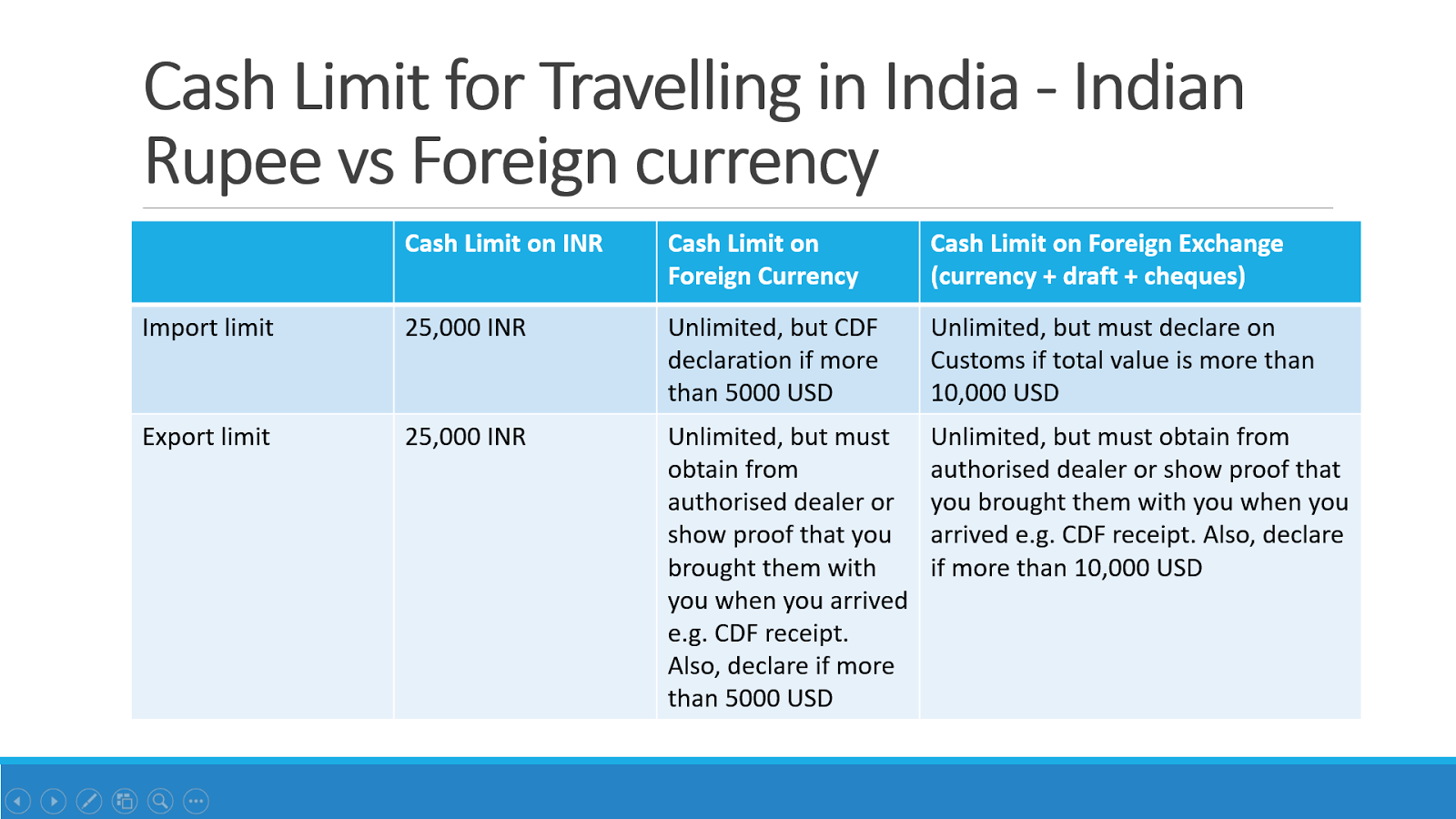

The RBI’s Foreign Exchange Management Act (FEMA) governs the import and export of currency, including US dollars. The regulations are designed to prevent money laundering, terrorist financing, and other illicit activities.

Declaration Requirements:

- Currency Declaration Form: All travelers entering India must declare the amount of foreign currency they are carrying, exceeding USD 10,000 (or equivalent in other currencies). This declaration is made on a Currency Declaration Form, available at the airport upon arrival.

- Purpose of Visit: Travelers must clearly state the purpose of their visit to India and the source of the foreign currency they are carrying.

- Verification: Customs officials may randomly select travelers for verification of their currency declarations.

Exchange of Currency:

- Authorized Dealers: Travelers can exchange foreign currency at authorized dealers, including banks, money changers, and designated airports.

- Exchange Rate: The exchange rate applied is determined by the prevailing market rate at the time of exchange.

- Documentation: Travelers must retain receipts for all currency exchange transactions.

Restrictions and Limitations:

- Restrictions on Cash: While there are no limits on the amount of US dollars that can be carried, the RBI restricts the amount of cash that can be brought into India. The limit for cash is INR 25,000 (approximately USD 330).

- Restrictions on Specific Currencies: Certain currencies, including those from countries under sanctions, may be subject to specific restrictions.

Importantly, travelers should be aware of the following:

- Penalties for Non-Compliance: Failure to comply with currency declaration regulations can result in penalties, including fines and confiscation of the undeclared currency.

- Avoid Cash Transfers: It is advisable to avoid carrying large amounts of cash, especially for long journeys. Consider using traveler’s checks or credit cards for larger transactions.

- Consult with Financial Institutions: Before traveling, consult with your bank or financial advisor to understand the latest currency regulations and any specific requirements for your trip.

Benefits of Understanding Currency Regulations:

- Smooth Travel: Understanding and complying with regulations ensures a smooth and hassle-free travel experience.

- Transparency and Compliance: Declaring foreign currency demonstrates transparency and adherence to the law, fostering trust with authorities.

- Protection from Penalties: Following regulations protects travelers from potential penalties and financial losses.

FAQs on Carrying US Dollars to India:

Q: Is there a limit on the amount of US dollars I can carry to India?

A: There is no explicit limit on the amount of US dollars you can carry to India. However, you must declare any amount exceeding USD 10,000 upon arrival.

Q: Can I bring cash or traveler’s checks to India?

A: Yes, you can bring both cash and traveler’s checks. However, there is a limit of INR 25,000 (approximately USD 330) on the amount of cash you can bring into India.

Q: What happens if I don’t declare my foreign currency?

A: Failure to declare foreign currency exceeding USD 10,000 can result in penalties, including fines and confiscation of the undeclared currency.

Q: Can I use my US dollar credit card in India?

A: Yes, you can use your US dollar credit card in India. However, you may incur foreign transaction fees.

Q: Where can I exchange my US dollars in India?

A: You can exchange your US dollars at authorized dealers, including banks, money changers, and designated airports.

Tips for Carrying US Dollars to India:

- Research and Prepare: Research currency regulations and exchange rates before your trip.

- Declare Accurately: Complete the Currency Declaration Form accurately and truthfully.

- Carry Receipts: Retain receipts for all currency exchange transactions.

- Use Traveler’s Checks: Consider using traveler’s checks for larger transactions, as they offer a level of security.

- Contact Your Bank: Contact your bank to understand any fees associated with using your US dollar credit card in India.

Conclusion:

Navigating currency regulations when traveling to India is essential for a smooth and compliant experience. By understanding the declaration requirements, exchange procedures, and limitations, travelers can ensure their journey is free from complications.

Remember, transparency, accuracy, and compliance are key to a hassle-free travel experience.

Closure

Thus, we hope this article has provided valuable insights into Navigating Currency Regulations: Understanding Dollar Limits for Travel to India. We thank you for taking the time to read this article. See you in our next article!