Navigating The Gold Market: Understanding The Best Times To Sell Your Jewelry

Navigating the Gold Market: Understanding the Best Times to Sell Your Jewelry

Related Articles: Navigating the Gold Market: Understanding the Best Times to Sell Your Jewelry

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Gold Market: Understanding the Best Times to Sell Your Jewelry. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Gold Market: Understanding the Best Times to Sell Your Jewelry

Gold, a precious metal with a rich history and enduring value, has long been considered a safe haven asset. However, its price fluctuates, influenced by a complex interplay of economic factors, global events, and market sentiment. Recognizing these fluctuations is crucial for anyone considering selling gold jewelry, as timing can significantly impact the potential return on investment.

Understanding the Factors Influencing Gold Prices:

Several key factors drive gold price movements, making it essential to understand their impact before deciding when to sell:

- Interest Rates: When interest rates rise, the opportunity cost of holding gold, which does not generate interest, increases. As a result, investors may prefer to invest in interest-bearing assets, leading to a decline in gold prices. Conversely, when interest rates fall, gold becomes more attractive, potentially pushing prices upward.

- Inflation: Gold is often seen as a hedge against inflation. When inflation rises, the purchasing power of money decreases, leading investors to seek assets that can preserve their wealth. Gold, with its intrinsic value, can act as a safe haven during periods of high inflation, potentially boosting its price.

- Economic Uncertainty: In times of economic uncertainty, investors may turn to gold as a safe haven asset. Political instability, geopolitical tensions, or economic downturns can drive investors towards gold, increasing its demand and potentially pushing prices higher.

- Currency Fluctuations: Gold is priced in US dollars. When the dollar weakens, gold becomes more expensive for investors holding other currencies, potentially leading to an increase in demand and higher prices. Conversely, a strong dollar can make gold less attractive, potentially leading to lower prices.

- Supply and Demand: Like any commodity, gold prices are influenced by supply and demand. Increased mining production can lead to lower prices, while a surge in demand, driven by factors like investment or jewelry purchases, can push prices higher.

Identifying Potential Opportunities:

While predicting gold prices with certainty is impossible, understanding these factors can help identify potential opportunities to sell gold jewelry:

- Periods of High Inflation: When inflation rises, gold’s value as a hedge against inflation can increase, making it a potentially favorable time to sell.

- Economic Uncertainty: During periods of economic instability, investors may seek safe haven assets, potentially driving up demand for gold.

- Weak Dollar: A weakening US dollar can make gold more expensive for investors holding other currencies, leading to an increase in demand.

- Increased Investment Demand: When investors perceive gold as a safe haven or a hedge against inflation, demand for gold can rise, potentially driving prices higher.

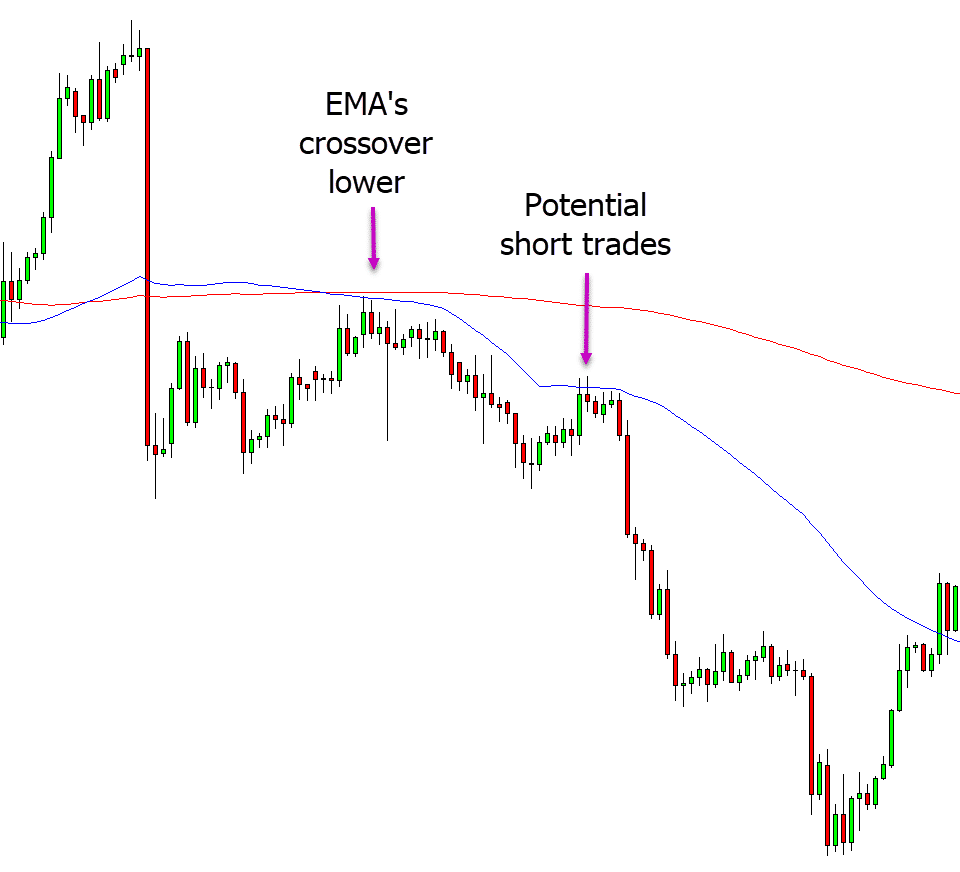

Analyzing Historical Trends:

Examining historical gold price data can provide insights into past trends and potential future movements. However, it is important to remember that past performance is not necessarily indicative of future results.

Consulting with Experts:

Before making any decisions, it is advisable to consult with a financial advisor or a reputable gold dealer. They can provide personalized advice based on your individual circumstances and current market conditions.

Understanding the Risks:

Selling gold jewelry involves inherent risks. While gold is a valuable asset, its price can fluctuate significantly, and you could potentially lose money if you sell at a time when prices are low.

FAQs about Selling Gold Jewelry:

1. What is the best time to sell gold jewelry?

There is no definitive "best" time to sell gold jewelry. The ideal time depends on individual circumstances, market conditions, and personal financial goals.

2. How do I know when the gold market is favorable?

Keep an eye on economic indicators, such as inflation rates, interest rates, and currency fluctuations. Follow news related to gold markets and consult with financial experts.

3. What are the risks associated with selling gold jewelry?

Gold prices can fluctuate, and you could potentially lose money if you sell when prices are low.

4. How can I get the best price for my gold jewelry?

Shop around and compare offers from different gold buyers, including local jewelers, online platforms, and gold refineries.

5. What factors affect the price of gold jewelry?

Factors influencing gold prices include interest rates, inflation, economic uncertainty, currency fluctuations, and supply and demand.

Tips for Selling Gold Jewelry:

- Research and Compare: Shop around and compare offers from different gold buyers.

- Consider the Gold Purity: The higher the karat, the more valuable your jewelry.

- Understand the Weight: The weight of your jewelry will determine its value.

- Check for Damage: Damaged or worn jewelry will typically fetch a lower price.

- Consider Insurance: If your jewelry is insured, consult with your insurance provider before selling.

- Document the Transaction: Keep a record of the sale, including the buyer’s details and the price.

Conclusion:

Selling gold jewelry can be a strategic decision, particularly during periods of economic uncertainty or high inflation. However, it is crucial to understand the factors influencing gold prices, analyze historical trends, and consult with financial experts before making any decisions. By carefully considering the market conditions and your own financial goals, you can potentially maximize your returns when selling gold jewelry.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Gold Market: Understanding the Best Times to Sell Your Jewelry. We thank you for taking the time to read this article. See you in our next article!