Navigating the Labyrinth: GST on Jewellery Making Charges

Related Articles: Navigating the Labyrinth: GST on Jewellery Making Charges

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Labyrinth: GST on Jewellery Making Charges. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Labyrinth: GST on Jewellery Making Charges

![GST on Gold Jewellery - Making Charges [2022] -Bizindigo](https://i0.wp.com/www.bizindigo.com/wp-content/uploads/2022/01/gst-on-gold-jewellery-bizindigo.png?fit=1200%2C630u0026ssl=1)

The world of jewellery, with its intricate designs and sparkling allure, is also subject to the complexities of taxation. One area that often raises questions is the application of Goods and Services Tax (GST) on jewellery making charges. This article delves into the intricacies of this aspect, providing a comprehensive understanding of the current regulations and their implications for both consumers and businesses within the jewellery industry.

Understanding the Basics: What are Jewellery Making Charges?

Jewellery making charges, also known as "making charges," encompass the costs associated with the transformation of raw materials into finished jewellery pieces. These charges cover various aspects of the manufacturing process, including:

- Design and craftsmanship: The skill and expertise involved in creating the jewellery design, including the intricate details and artistic elements.

- Material processing: The costs associated with preparing, shaping, and refining the raw materials used in the jewellery, such as melting, casting, and polishing.

- Labour costs: The wages paid to skilled artisans and craftsmen who contribute to the creation of the jewellery.

- Overheads: The operational expenses incurred by the jeweller, such as rent, utilities, and administrative costs.

GST and Jewellery: A Complex Relationship

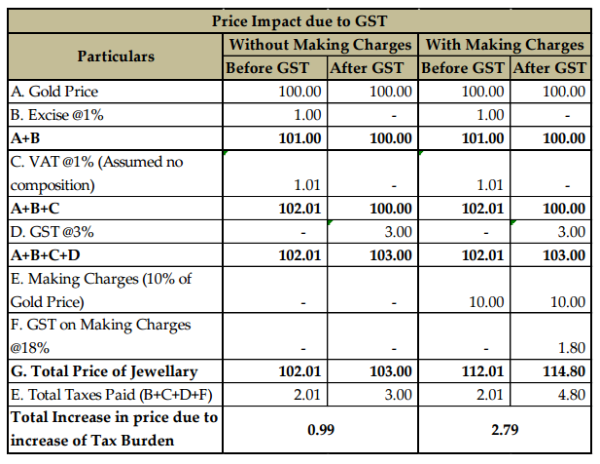

The GST regime in India classifies jewellery under HSN Code 7113 and applies a 3% GST rate on the final sale price of jewellery. However, the application of GST on jewellery making charges presents a unique scenario, requiring a closer examination.

The Current Scenario: GST on Making Charges

The prevailing interpretation of the GST rules is that making charges are considered an integral part of the final sale price of jewellery. Therefore, GST is levied on the entire value, including the cost of raw materials and making charges. This means that when you purchase a piece of jewellery, you are effectively paying GST on both the raw materials and the labour involved in its creation.

Why This Matters: The Impact on Consumers and Businesses

This approach has several implications for both consumers and businesses in the jewellery sector:

For Consumers:

- Increased Cost: The inclusion of making charges in the GST calculation leads to a higher final price for consumers, as they are effectively paying GST on the entire value of the jewellery, including the cost of manufacturing.

- Transparency: While the GST on making charges might seem like an added cost, it also promotes transparency in the pricing structure. Consumers can clearly see the breakdown of the price, including the cost of raw materials and the making charges.

- Potential for Confusion: The complex interplay between GST and making charges can create confusion for consumers, who might not fully understand the implications of these charges on the final price.

For Businesses:

- Increased Compliance: Businesses need to carefully track and report the making charges as part of their GST compliance, adding an extra layer of complexity to their operations.

- Price Competition: The inclusion of making charges in the GST calculation can affect the competitive landscape, as businesses might need to adjust their pricing strategies to remain competitive.

- Potential for Disputes: There is a potential for disputes between businesses and tax authorities regarding the interpretation of GST on making charges, leading to uncertainties and potential financial implications.

Navigating the Labyrinth: A Deeper Dive

To gain a deeper understanding of the intricacies of GST on making charges, let’s explore some key aspects:

1. The Role of Input Tax Credit (ITC)

Jewellery manufacturers can claim input tax credit (ITC) on the GST paid on inputs used in the manufacturing process. This includes the GST paid on raw materials, machinery, and other inputs used in the making of jewellery. The ITC can offset the output GST liability on the sale of jewellery, effectively reducing the overall tax burden for the manufacturer.

2. The Importance of Proper Documentation

Maintaining proper documentation is crucial for both consumers and businesses. Consumers should ensure that they receive a detailed invoice that clearly outlines the breakdown of the price, including the cost of raw materials and the making charges. Businesses, on the other hand, need to maintain accurate records of their purchases, sales, and making charges to ensure compliance with GST regulations.

3. The Impact of Different Jewellery Categories

The application of GST on making charges might vary slightly depending on the type of jewellery being sold. For instance, handcrafted jewellery might have higher making charges compared to mass-produced jewellery, leading to a higher overall GST liability.

4. The Potential for Future Changes

The GST regime is constantly evolving, and there is a possibility of changes in the interpretation or implementation of GST on making charges. Businesses and consumers need to stay informed about any updates or amendments to the GST regulations to ensure compliance.

FAQs on GST on Jewellery Making Charges

Q1: Are making charges considered part of the sale price of jewellery for GST purposes?

A: Yes, making charges are considered an integral part of the final sale price of jewellery for GST purposes. Therefore, GST is levied on the entire value, including the cost of raw materials and making charges.

Q2: Can I claim input tax credit (ITC) on the GST paid on making charges?

A: No, you cannot claim ITC on the GST paid on making charges. This is because making charges are considered a service and not a supply of goods.

Q3: How are making charges reflected in the final invoice?

A: The final invoice should clearly outline the breakdown of the price, including the cost of raw materials and the making charges. This ensures transparency and allows consumers to understand the components of the final price.

Q4: What are the implications of GST on making charges for businesses?

A: Businesses need to carefully track and report the making charges as part of their GST compliance. They also need to consider the impact of these charges on their pricing strategies and overall profitability.

Q5: Are there any exemptions or special provisions for GST on making charges?

A: Currently, there are no specific exemptions or special provisions for GST on making charges. However, the GST regime is subject to change, and it is important to stay informed about any updates or amendments.

Tips for Navigating GST on Jewellery Making Charges

- Seek Professional Advice: Consult with a tax professional or chartered accountant to understand the specific implications of GST on making charges for your business or personal transactions.

- Maintain Accurate Records: Keep detailed records of all purchases, sales, and making charges to ensure compliance with GST regulations.

- Stay Informed: Stay updated on any changes or amendments to GST regulations related to jewellery making charges.

- Negotiate with Suppliers: Discuss the inclusion of making charges in the price with your suppliers to ensure transparency and clarity in the pricing structure.

Conclusion: A Path Towards Transparency

The application of GST on jewellery making charges is a complex area that requires careful consideration and understanding. While it might lead to higher prices for consumers, it also promotes transparency in the pricing structure and ensures compliance with tax regulations. By staying informed, maintaining accurate records, and seeking professional advice, both businesses and consumers can navigate this intricate landscape effectively and ensure a smooth and compliant journey within the world of jewellery.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Labyrinth: GST on Jewellery Making Charges. We hope you find this article informative and beneficial. See you in our next article!