Navigating the World of Gold Ownership: A Comprehensive Guide

Related Articles: Navigating the World of Gold Ownership: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the World of Gold Ownership: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Gold Ownership: A Comprehensive Guide

Gold, a precious metal with a history spanning millennia, has long held a place of significance in human society. From its use as currency to its role as a safe haven asset, gold has consistently played a vital role in shaping economies and influencing individual financial decisions. However, the question of how much gold an individual can legally own remains a subject of considerable interest and often sparks confusion. This comprehensive guide aims to provide clarity on the nuances of gold ownership, exploring the legal frameworks, historical context, and practical considerations surrounding this topic.

The Global Landscape of Gold Ownership

Unlike many other assets, there is no universally enforced limit on how much gold an individual can possess. The legal framework governing gold ownership varies significantly across the globe, with different countries adopting distinct regulations.

Countries with No Restrictions:

Several countries, including the United States, Canada, Australia, and the United Kingdom, have no legal restrictions on the amount of gold an individual can own. In these jurisdictions, individuals are free to purchase, hold, and trade gold without facing any limitations.

Countries with Restrictions:

In contrast, some countries impose restrictions on gold ownership, often driven by economic, political, or historical considerations. These restrictions can take various forms, including:

- Quantity Limits: Some countries may impose a maximum amount of gold that an individual can own. This limit might be set in terms of weight, value, or both.

- Licensing Requirements: Certain countries may require individuals to obtain licenses or permits to purchase, hold, or trade gold.

- Reporting Obligations: Individuals might be required to report their gold holdings to authorities, particularly if they exceed a specific threshold.

- Export/Import Restrictions: Some countries may limit the amount of gold that can be exported or imported.

Understanding the Rationale Behind Restrictions

The reasons behind gold ownership restrictions can vary considerably. Some common motivations include:

- Economic Control: Governments may seek to control the flow of gold to influence their currency value or to manage inflation.

- National Security: In times of political instability or conflict, governments might restrict gold ownership to prevent its use for illicit activities or to maintain control over valuable resources.

- Currency Stability: Some countries might restrict gold ownership to prevent the erosion of their national currency.

- Taxation: Governments may impose taxes on gold ownership to generate revenue.

The Importance of Legal Compliance

It is crucial for individuals to familiarize themselves with the gold ownership laws and regulations applicable to their location. Failure to comply with these rules can lead to significant legal consequences, including fines, penalties, or even asset forfeiture.

Navigating the World of Gold Ownership: Practical Considerations

Beyond the legal framework, several practical considerations come into play when deciding how much gold to own. These include:

- Financial Goals: Individuals should consider their financial objectives and how gold ownership aligns with their overall investment strategy.

- Risk Tolerance: Gold is a volatile asset, and its value can fluctuate significantly. Individuals should assess their risk tolerance before investing a substantial portion of their portfolio in gold.

- Liquidity: Gold can be illiquid, meaning it may take time to convert it into cash. This factor should be considered when deciding how much gold to own.

- Storage and Security: Safeguarding gold requires proper storage and security measures to prevent theft or damage.

- Tax Implications: Gold ownership may be subject to various taxes, including capital gains tax, income tax, and property tax.

FAQs Regarding Gold Ownership

1. Is it legal to own gold in the United States?

Yes, owning gold is legal in the United States. There are no restrictions on the amount of gold an individual can own.

2. What are the tax implications of owning gold?

Gold ownership may be subject to various taxes, depending on the jurisdiction. In the United States, for example, capital gains tax may apply to profits realized from selling gold.

3. How can I store my gold safely?

Gold can be stored in various ways, including:

- Home Safe: A home safe can provide a basic level of security.

- Bank Safe Deposit Box: A bank safe deposit box offers greater security, but it may come with fees.

- Gold Storage Companies: Specialized companies offer secure storage solutions for gold, often with insurance coverage.

4. What are the risks associated with owning gold?

Gold ownership involves several risks, including:

- Price Volatility: Gold prices can fluctuate significantly, potentially leading to losses.

- Liquidity Issues: It can be difficult to sell gold quickly and at a desired price.

- Storage Costs: Storing gold can incur costs for safe deposit boxes or specialized storage facilities.

5. What are the benefits of owning gold?

Gold ownership offers several potential benefits, including:

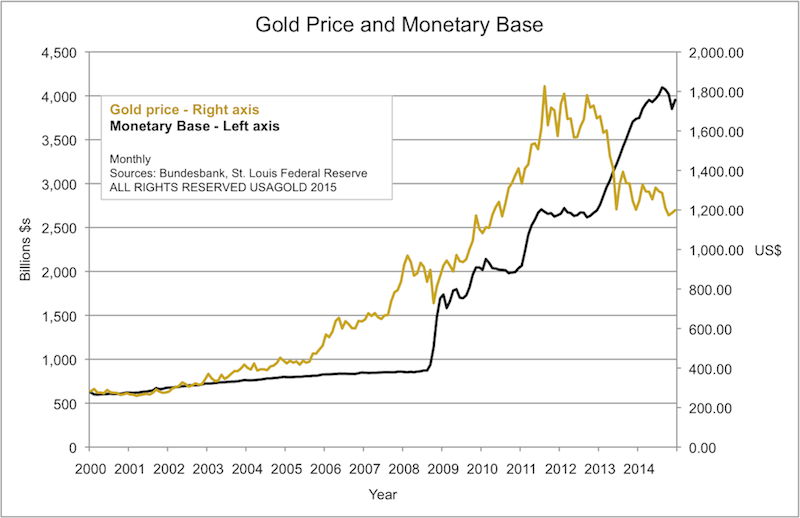

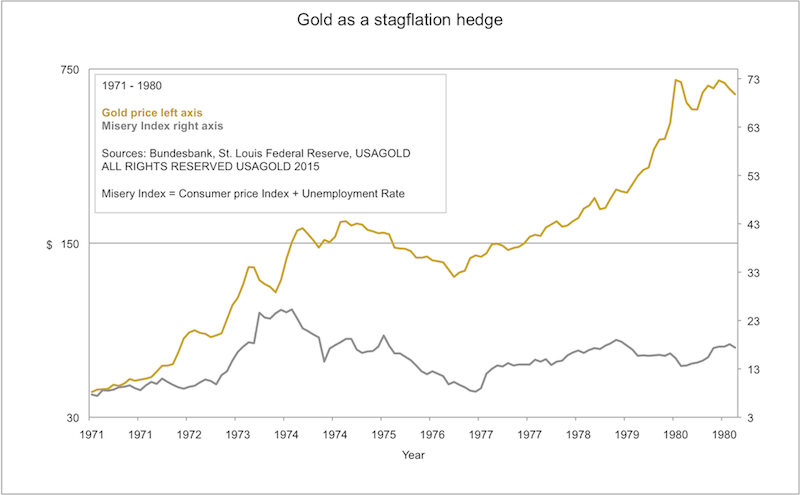

- Inflation Hedge: Gold can act as a hedge against inflation, as its value tends to increase during periods of rising prices.

- Safe Haven Asset: Gold is often considered a safe haven asset, as its value tends to rise during times of economic uncertainty.

- Diversification: Gold can help diversify an investment portfolio, reducing overall risk.

Tips for Gold Ownership

- Do Your Research: Thoroughly research the legal framework, tax implications, and storage options for gold ownership in your jurisdiction.

- Set Clear Goals: Define your financial objectives and determine how gold ownership aligns with your overall investment strategy.

- Consider Risk Tolerance: Assess your risk tolerance and invest in gold only if you are comfortable with the associated volatility.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your portfolio by including other asset classes alongside gold.

- Choose a Reputable Dealer: Purchase gold from a reputable dealer with a good track record.

- Store Gold Securely: Choose a safe and secure method for storing your gold, considering factors like cost, convenience, and insurance coverage.

Conclusion

Gold ownership remains a complex and multifaceted topic, with legal frameworks, practical considerations, and individual financial goals playing a significant role. While there is no universally enforced limit on gold ownership, understanding the legal landscape and navigating the practical aspects are crucial for individuals seeking to incorporate this precious metal into their investment portfolios. By carefully considering their financial objectives, risk tolerance, and legal obligations, individuals can make informed decisions regarding gold ownership and potentially reap its benefits while mitigating potential risks.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Gold Ownership: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!