The American and Gold: Understanding Ownership Limits and Benefits

Related Articles: The American and Gold: Understanding Ownership Limits and Benefits

Introduction

With great pleasure, we will explore the intriguing topic related to The American and Gold: Understanding Ownership Limits and Benefits. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The American and Gold: Understanding Ownership Limits and Benefits

The allure of gold, a precious metal steeped in history and perceived as a safe haven asset, has drawn investors and individuals for centuries. While the United States does not impose explicit limits on the amount of gold an individual can own, various regulations and considerations play a role in navigating this ownership. This article provides a comprehensive overview of the legal framework surrounding gold ownership in the United States, exploring its benefits and highlighting key aspects to consider.

The Absence of Explicit Limits:

Unlike some countries, the United States does not have a specific law dictating the maximum amount of gold an individual can possess. This freedom stems from the principles of private property enshrined in the Constitution. The U.S. government generally does not interfere with an individual’s right to acquire, hold, and dispose of gold as they see fit.

Reporting Requirements and Potential Scrutiny:

While there are no explicit limits, certain reporting requirements and potential scrutiny may arise depending on the volume and nature of gold transactions. For instance, individuals engaging in large-scale gold transactions, particularly those involving international transfers or exceeding certain monetary thresholds, may be subject to reporting obligations under the Bank Secrecy Act (BSA) and the USA PATRIOT Act. These regulations are primarily aimed at combating money laundering and terrorist financing, not restricting gold ownership.

Tax Implications of Gold Ownership:

Gold ownership in the United States is generally subject to capital gains tax when sold. If gold is held as an investment and sold for a profit, the difference between the purchase price and the selling price is considered a capital gain and taxed accordingly. The tax rate on capital gains varies depending on the holding period and the individual’s income bracket.

Physical Possession vs. Paper Gold:

Individuals have several options for holding gold. Physical gold, in the form of bullion, coins, or jewelry, offers tangible ownership and the potential for storage in a safe deposit box or at home. However, physical possession requires careful security measures and insurance.

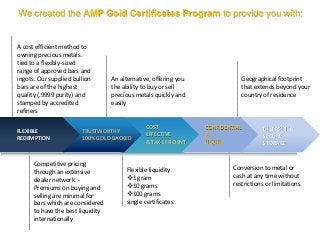

Paper gold, represented by gold exchange-traded funds (ETFs), gold futures, or gold certificates, offers an alternative way to invest in gold without physical ownership. These instruments track the price of gold, allowing investors to participate in its price movements without the complexities of physical storage.

Benefits of Gold Ownership:

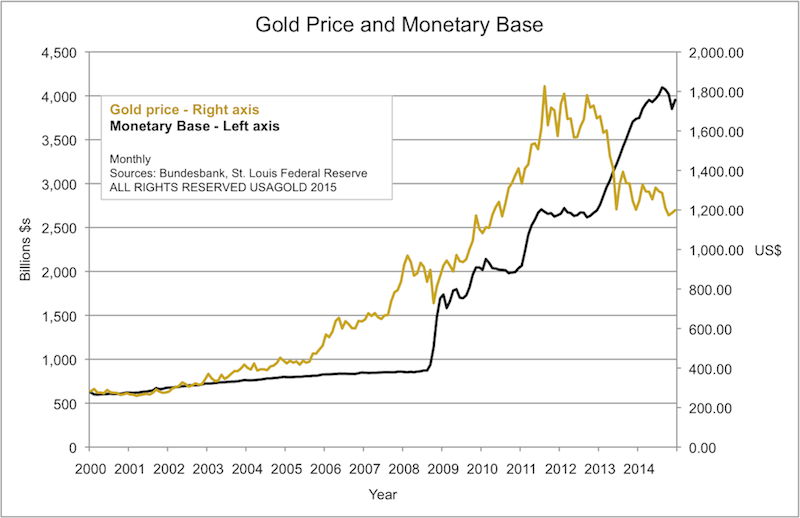

Gold has been a traditional safe haven asset for centuries, offering potential benefits during periods of economic uncertainty and market volatility.

- Inflation Hedge: Gold’s price tends to rise during periods of inflation, as its value is not tied to fiat currencies. This can help preserve purchasing power during times of economic instability.

- Diversification: Adding gold to a diversified investment portfolio can potentially reduce overall portfolio risk, as gold’s price movements often differ from other asset classes like stocks and bonds.

- Store of Value: Gold has historically been considered a store of value, retaining its purchasing power over long periods.

Considerations for Gold Ownership:

While gold ownership offers potential benefits, it’s essential to consider the following:

- Volatility: Gold prices can fluctuate significantly, leading to potential losses in the short term.

- Storage Costs: Physical gold requires secure storage, which can involve costs for safe deposit boxes or home security measures.

- Liquidity: While gold is a generally liquid asset, large-scale sales may impact its price and require time to find a buyer.

Conclusion:

The United States does not impose explicit limits on the amount of gold an individual can own. While reporting requirements and potential scrutiny may arise for large-scale transactions, the right to own gold is generally upheld. Gold ownership offers potential benefits as an inflation hedge, a diversification tool, and a store of value. However, investors should carefully consider the volatility, storage costs, and liquidity aspects before making investment decisions.

Frequently Asked Questions

Q: Can I be fined or penalized for owning too much gold?

A: No, there are no legal penalties for owning a large amount of gold in the United States. However, large-scale gold transactions may trigger reporting requirements under anti-money laundering and counter-terrorism financing regulations.

Q: What is the best way to store gold?

A: The best way to store gold depends on the individual’s needs and preferences. Options include:

- Safe Deposit Boxes: Banks offer secure storage facilities for valuables, including gold.

- Home Storage: Individuals may choose to store gold at home, but this requires robust security measures and insurance.

- Gold ETFs or Gold Certificates: These paper gold instruments allow investors to participate in gold’s price movements without physical ownership.

Q: How do I pay taxes on gold?

A: Gold ownership is generally subject to capital gains tax when sold. The tax rate on capital gains varies depending on the holding period and the individual’s income bracket. It’s advisable to consult with a tax advisor for specific guidance.

Q: Is it legal to buy gold online?

A: Yes, it is legal to buy gold online from reputable dealers. However, it’s crucial to verify the legitimacy of the dealer and ensure the gold is of the stated purity and weight.

Q: Can I use gold as collateral for a loan?

A: Some financial institutions may accept gold as collateral for loans, but the terms and conditions vary. It’s essential to research and compare different lenders before making a decision.

Tips for Gold Ownership

- Do your research: Thoroughly understand the risks and benefits of gold ownership before investing.

- Diversify your portfolio: Don’t allocate all your assets to gold. Diversify your investments across different asset classes.

- Choose reputable dealers: When buying physical gold, select reputable dealers with a proven track record.

- Secure storage: Ensure your gold is stored securely, whether in a safe deposit box or at home.

- Consult a financial advisor: Seek professional advice from a qualified financial advisor to develop a personalized investment strategy.

Conclusion:

Gold ownership in the United States is a complex topic with various legal and practical considerations. While there are no explicit limits on the amount of gold an individual can own, reporting requirements and potential scrutiny may arise for large-scale transactions. Understanding the benefits and risks of gold ownership, along with the legal framework surrounding it, is crucial for making informed investment decisions.

Closure

Thus, we hope this article has provided valuable insights into The American and Gold: Understanding Ownership Limits and Benefits. We appreciate your attention to our article. See you in our next article!