The Fluctuating Value of 24 Karat Gold: A Comprehensive Guide

Related Articles: The Fluctuating Value of 24 Karat Gold: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Fluctuating Value of 24 Karat Gold: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: The Fluctuating Value of 24 Karat Gold: A Comprehensive Guide

- 2 Introduction

- 3 The Fluctuating Value of 24 Karat Gold: A Comprehensive Guide

- 3.1 Understanding Karat Purity: The Essence of Value

- 3.2 The Dynamic Nature of Gold Pricing

- 3.3 Determining the Price of 24 Karat Gold: A Multifaceted Approach

- 3.4 Factors Influencing Gold Price Volatility: A Deeper Dive

- 3.5 FAQs: Unraveling the Mysteries of Gold Pricing

- 3.6 Tips for Buying and Selling 24 Karat Gold: A Practical Guide

- 3.7 Conclusion: The Enduring Appeal of 24 Karat Gold

- 4 Closure

The Fluctuating Value of 24 Karat Gold: A Comprehensive Guide

Gold, a precious metal prized for its beauty, durability, and historical significance, has held a prominent position in human society for millennia. Its value, however, is not static. Understanding the factors that influence the price of 24 karat gold is essential for investors, collectors, and anyone interested in this valuable commodity.

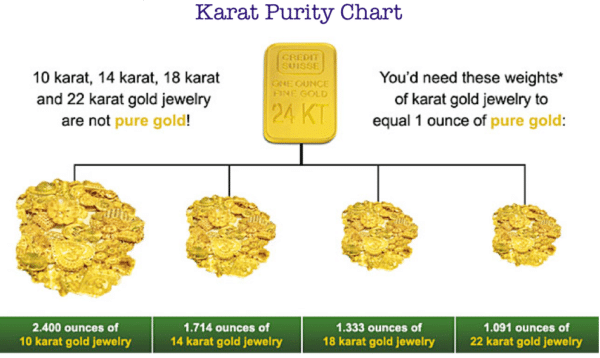

Understanding Karat Purity: The Essence of Value

The term "karat" measures the purity of gold. 24 karat gold represents pure gold, unmixed with any other metals. Lower karat gold, such as 18 karat, contains a percentage of other metals, typically silver, copper, or nickel, which are added to enhance its durability and workability. The higher the karat number, the purer the gold and, generally, the higher its value.

The Dynamic Nature of Gold Pricing

Gold prices fluctuate constantly, influenced by a complex interplay of factors, including:

1. Global Economic Conditions: Economic uncertainty and geopolitical instability often drive investors towards safe-haven assets like gold. During periods of economic turmoil, demand for gold increases, pushing its price upward. Conversely, strong economic growth and stability can lead to a decrease in gold prices as investors seek riskier investments with higher potential returns.

2. Central Bank Policies: Central banks worldwide play a significant role in the gold market. Their decisions regarding gold reserves, purchase and sale of gold, and interest rate policies can impact the supply and demand for gold, influencing its price.

3. Inflation and Interest Rates: Inflation erodes the purchasing power of currencies, making gold, which is a hedge against inflation, more attractive. Conversely, rising interest rates can make holding gold less appealing as investors can earn a higher return on their investments in other assets.

4. Currency Exchange Rates: Gold is priced in US dollars. Fluctuations in exchange rates between the US dollar and other currencies can impact the price of gold for buyers in different countries.

5. Demand from Jewelers and Industrial Users: The demand for gold from jewelers and industrial users, such as electronics manufacturers, also affects its price. Increased demand from these sectors can lead to higher gold prices.

6. Supply and Production Costs: The availability of gold from mines and the costs associated with mining, refining, and transportation all play a role in determining its price.

Determining the Price of 24 Karat Gold: A Multifaceted Approach

The price of 24 karat gold is typically quoted in US dollars per ounce or gram. However, determining the actual cost of 24 karat gold involves more than just consulting a price quote. Several factors come into play:

1. Gold Spot Price: This is the current market price of gold, usually quoted in real-time on financial exchanges. It reflects the most recent trading activity and serves as a benchmark for gold pricing.

2. Gold Premiums: These are additional charges added to the spot price by retailers and dealers. They cover their operating costs, profit margins, and the costs associated with refining, manufacturing, and transportation.

3. Gold Bullion vs. Gold Jewelry: Gold bullion, which is pure gold in the form of bars or coins, typically carries lower premiums than gold jewelry. Jewelry often includes additional costs for design, craftsmanship, and gemstones, all of which contribute to its overall price.

4. Gold Investment Products: Gold exchange-traded funds (ETFs) and gold mutual funds offer investors a way to invest in gold without physically owning it. These investment products have their own fees and charges that need to be considered.

5. Gold Futures and Options: Futures and options contracts allow investors to speculate on the future price of gold. These contracts have their own unique pricing mechanisms and associated risks.

Factors Influencing Gold Price Volatility: A Deeper Dive

The price of 24 karat gold is highly volatile, subject to constant fluctuations. Several key factors contribute to this volatility:

1. Economic Uncertainty: Global economic events, such as recessions, financial crises, and political instability, can significantly impact gold prices. In times of uncertainty, investors often turn to gold as a safe-haven asset, driving its price higher.

2. Interest Rate Changes: Changes in interest rates set by central banks can influence the attractiveness of gold as an investment. Higher interest rates can make holding gold less appealing as investors can earn a higher return on their investments in other assets, potentially leading to a decrease in gold prices.

3. Currency Fluctuations: Gold is priced in US dollars. Fluctuations in the value of the US dollar against other currencies can impact the price of gold for buyers in different countries. A stronger US dollar generally leads to lower gold prices, while a weaker US dollar can result in higher gold prices.

4. Supply and Demand Dynamics: Changes in the supply of gold from mines and the demand for gold from investors, jewelers, and industrial users can also contribute to price volatility. Increased supply can lead to lower prices, while increased demand can drive prices higher.

5. Speculative Trading: Speculative trading in gold futures and options markets can amplify price fluctuations. Investors who believe that gold prices will rise may buy futures contracts, increasing demand and pushing prices upward. Conversely, investors who anticipate a decline in gold prices may sell futures contracts, driving prices down.

FAQs: Unraveling the Mysteries of Gold Pricing

1. What is the current price of 24 karat gold?

The current price of 24 karat gold can be found on financial websites and news sources that track precious metals prices. These websites typically provide real-time quotes for the spot price of gold, which is the price for immediate delivery.

2. How can I buy 24 karat gold?

You can buy 24 karat gold from a variety of sources, including:

- Gold Dealers and Refiners: These businesses specialize in buying and selling gold bullion, coins, and jewelry.

- Banks and Financial Institutions: Some banks offer gold investment products, such as gold ETFs and gold mutual funds.

- Online Marketplaces: Several online platforms allow you to buy and sell gold, offering a convenient and transparent way to transact.

3. Is it better to buy gold bullion or gold jewelry?

The choice between gold bullion and gold jewelry depends on your investment goals. Gold bullion is a more pure form of gold and typically carries lower premiums than gold jewelry. However, gold jewelry can be a more tangible investment, offering both financial value and aesthetic appeal.

4. How can I protect myself from gold price fluctuations?

Gold prices are inherently volatile. Here are some ways to mitigate risk:

- Dollar-Cost Averaging: Invest a fixed amount of money in gold at regular intervals, regardless of the price, to smooth out your average purchase price.

- Long-Term Investment: Consider gold as a long-term investment, as its value tends to appreciate over time.

- Diversification: Spread your investments across different asset classes, including gold, to reduce overall risk.

5. What are the risks associated with investing in gold?

Investing in gold carries certain risks:

- Price Volatility: Gold prices can fluctuate significantly, leading to potential losses.

- Lack of Dividends or Interest: Gold does not generate dividends or interest payments.

- Storage Costs: Storing physical gold can involve costs for security and insurance.

- Counterfeit Risk: Be cautious when buying physical gold, as counterfeit products exist.

Tips for Buying and Selling 24 Karat Gold: A Practical Guide

1. Research and Compare Prices: Before buying gold, research different dealers, retailers, and online platforms to compare prices and premiums.

2. Choose Reputable Dealers: Only buy gold from reputable dealers with a proven track record. Look for dealers who are members of industry associations and have positive customer reviews.

3. Verify Authenticity: Ensure the authenticity of gold by requesting a certificate of authenticity or having it tested by an independent assayer.

4. Store Gold Safely: If you buy physical gold, store it securely in a safe deposit box or a secure home safe.

5. Consider Insurance: Insure your gold against theft, damage, and other risks.

6. Stay Informed about Market Trends: Keep up-to-date on gold market trends and news to make informed investment decisions.

Conclusion: The Enduring Appeal of 24 Karat Gold

24 karat gold, the purest form of this precious metal, continues to hold a unique allure. Its value, though subject to fluctuations, is rooted in its historical significance, its enduring beauty, and its role as a safe-haven asset during times of economic uncertainty. Understanding the factors that influence gold prices, navigating the complexities of buying and selling, and adopting sound investment strategies are essential for anyone seeking to capitalize on the potential of this valuable commodity. By remaining informed and making calculated decisions, individuals can harness the enduring appeal of 24 karat gold to their advantage.

-p-1600.jpeg)

Closure

Thus, we hope this article has provided valuable insights into The Fluctuating Value of 24 Karat Gold: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!