The Impact of GST on Gold Jewelry in 2025: A Comprehensive Analysis

Related Articles: The Impact of GST on Gold Jewelry in 2025: A Comprehensive Analysis

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Impact of GST on Gold Jewelry in 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Impact of GST on Gold Jewelry in 2025: A Comprehensive Analysis

The Indian gold jewelry market, a cornerstone of the nation’s cultural heritage and economic landscape, continues to evolve under the influence of various factors, including government policies. One such policy, the Goods and Services Tax (GST), has significantly impacted the gold jewelry industry since its implementation in 2017. As we approach 2025, it is crucial to understand the existing framework and its potential future implications on the gold jewelry market.

Understanding GST on Gold Jewelry

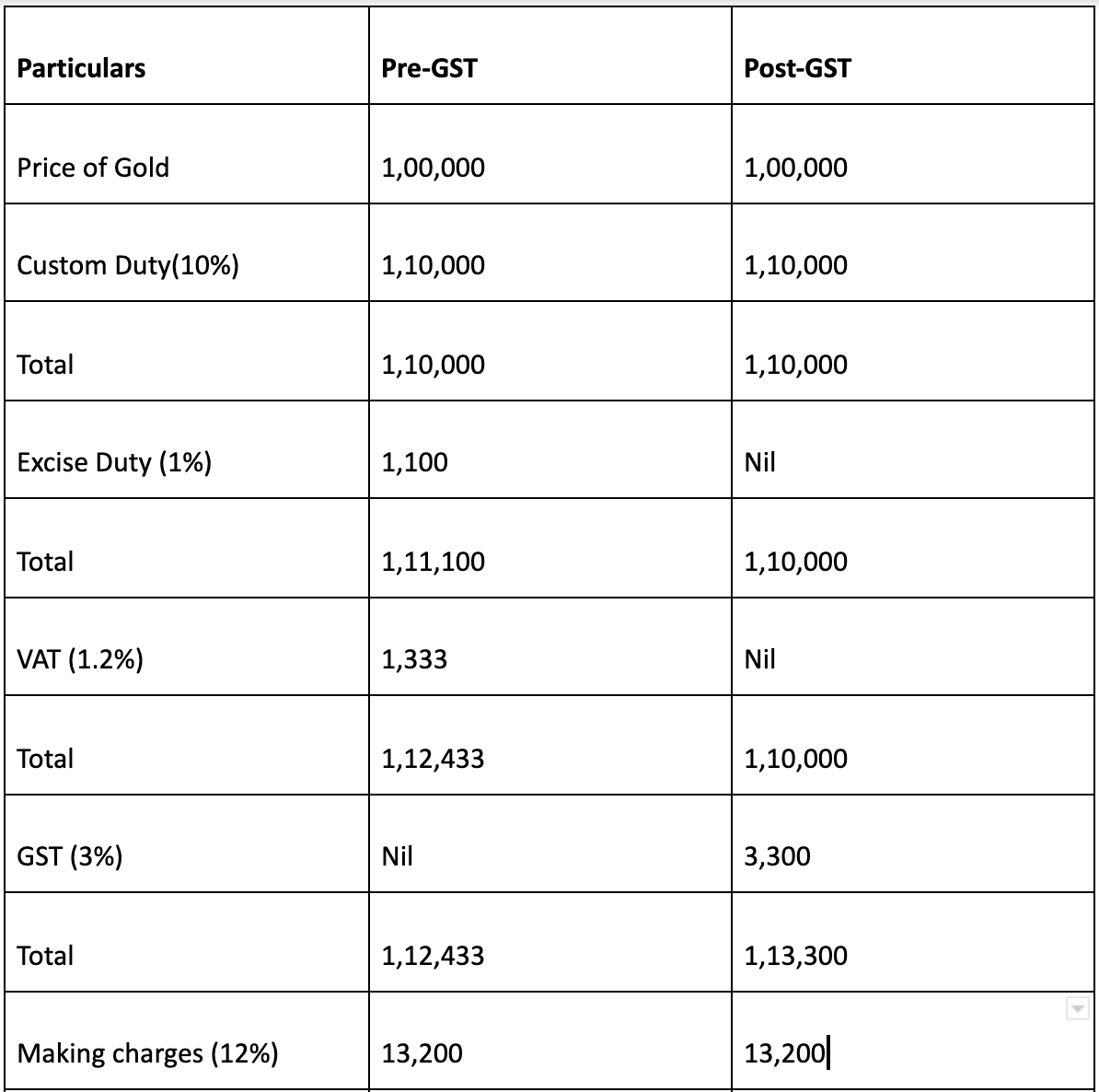

The GST on gold jewelry is currently levied at a standard rate of 3%, inclusive of a cess of 1% on the final price. This structure has brought about notable changes within the industry, impacting both consumers and businesses.

Benefits of GST on Gold Jewelry

-

Streamlined Taxation: The introduction of GST has led to a unified tax system, eliminating the complexities of multiple state-level taxes. This has streamlined the tax collection process for businesses, reducing compliance costs and administrative burdens.

-

Increased Transparency: The GST regime has fostered greater transparency in the gold jewelry market. Consumers can now easily identify the price breakdown, including the GST component, ensuring clarity and accountability.

-

Reduced Tax Evasion: The GST’s nationwide implementation has significantly curbed tax evasion, as it has made it more difficult for businesses to operate in the informal sector. This has leveled the playing field for honest businesses and fostered a fairer market.

-

Boost to Organized Sector: The GST has encouraged businesses to formalize their operations, contributing to the growth of the organized sector. This has led to improved quality control, standardization, and consumer confidence in the gold jewelry market.

-

Simplified Logistics: GST has simplified the logistics of inter-state trade, reducing the time and cost associated with transporting gold jewelry across state borders. This has facilitated smoother supply chains and improved market efficiency.

Challenges and Potential Developments in 2025

Despite the benefits, certain challenges remain in the implementation of GST on gold jewelry.

-

Complexity of Valuation: Determining the correct valuation of gold jewelry for GST purposes can be complex due to factors like purity, craftsmanship, and design. This can lead to disputes and delays in tax compliance.

-

Impact on Small-Scale Businesses: Small-scale businesses, particularly those operating in the unorganized sector, may struggle to adapt to the GST compliance requirements. This can lead to a reduction in their competitiveness and potentially force them to shut down.

-

Potential for Rate Adjustments: The GST rate on gold jewelry could be subject to future adjustments based on economic conditions and government policy changes. Any rate changes would impact the pricing of gold jewelry and the profitability of businesses.

Looking Ahead: Potential Future Scenarios

While the current GST rate on gold jewelry remains stable, future developments could influence its impact on the market in 2025.

-

Rate Reduction: The government could consider reducing the GST rate on gold jewelry to stimulate demand and boost the industry’s growth. This would likely result in lower prices for consumers, making gold jewelry more accessible.

-

Tax Structure Reform: The GST Council could explore alternative tax structures for gold jewelry, such as a tiered system based on purity or a combination of ad valorem and specific rates.

-

Technological Advancements: The increasing adoption of technology, such as blockchain and artificial intelligence, could streamline the gold jewelry supply chain and improve GST compliance.

FAQs on GST on Gold Jewelry in 2025

1. What is the current GST rate on gold jewelry?

The current GST rate on gold jewelry is 3%, inclusive of a cess of 1% on the final price.

2. How does GST impact the price of gold jewelry?

The GST is included in the final price of gold jewelry. Therefore, a higher GST rate would lead to a higher final price for consumers.

3. What are the implications of GST for small-scale gold jewelry businesses?

Small-scale businesses may face challenges in complying with GST regulations, particularly in terms of recordkeeping and tax filing. This could impact their profitability and competitiveness.

4. What are the potential future changes to GST on gold jewelry?

The GST rate on gold jewelry could be subject to future adjustments based on economic conditions and government policy changes. The GST Council might also consider alternative tax structures for gold jewelry.

5. How can I ensure I am paying the correct GST on gold jewelry?

Always ask for a detailed receipt that clearly outlines the price breakdown, including the GST component. You can also verify the GST details with the seller or refer to the official GST website.

Tips for Consumers and Businesses

Consumers:

- Demand Transparency: Inquire about the price breakdown, including the GST component, before making a purchase.

- Compare Prices: Compare prices from different sellers to ensure you are getting the best deal.

- Check for GST Compliance: Ensure that the seller is registered under GST and provides a valid tax invoice.

Businesses:

- Stay Updated: Keep abreast of any changes in GST regulations and compliance requirements.

- Invest in Technology: Implement technology solutions to streamline GST compliance and improve efficiency.

- Seek Professional Advice: Consult with tax professionals to ensure accurate GST compliance and minimize risks.

Conclusion

The GST on gold jewelry has had a significant impact on the Indian market, bringing about both benefits and challenges. As we move towards 2025, the future of GST on gold jewelry remains uncertain, with potential for rate adjustments, tax structure reforms, and technological advancements. By understanding the existing framework and potential future developments, both consumers and businesses can navigate the evolving landscape of the gold jewelry market and make informed decisions. The role of GST in shaping the future of the gold jewelry industry is undeniable, and its continued evolution will be crucial in fostering growth, transparency, and fair competition within the sector.

Closure

Thus, we hope this article has provided valuable insights into The Impact of GST on Gold Jewelry in 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!