The Limits of Gold Ownership: A Global Perspective

Related Articles: The Limits of Gold Ownership: A Global Perspective

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Limits of Gold Ownership: A Global Perspective. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Limits of Gold Ownership: A Global Perspective

Gold, a precious metal coveted for centuries, has historically served as a store of value, a hedge against inflation, and a safe haven during economic uncertainty. However, the question of how much gold an individual can legally own often arises, particularly in the context of global investment strategies and personal wealth management.

The answer to this question is not straightforward, as it varies significantly across jurisdictions. There are no universally established limits on gold ownership, and the regulations governing its possession differ widely from country to country. This article aims to provide a comprehensive overview of the legal frameworks surrounding gold ownership, highlighting the key factors that influence its limits and the potential benefits of holding this precious metal.

The Absence of Global Restrictions:

It is crucial to understand that no international body or treaty imposes universal limits on gold ownership. The decision to regulate gold ownership rests primarily with individual nations, and their motivations for doing so can vary.

Factors Influencing Gold Ownership Limits:

Several key factors influence the legal framework surrounding gold ownership:

- Economic Stability and Currency Strength: Countries with weaker currencies or experiencing economic instability often implement restrictions on gold ownership to prevent capital flight and maintain control over their monetary policy.

- Taxation and Revenue Generation: Some nations impose taxes on gold ownership or transactions, seeking to generate revenue from this valuable asset.

- Anti-Money Laundering and Terrorism Financing: Regulations aimed at combating money laundering and financing terrorism may restrict large-scale gold transactions and require reporting of suspicious activities.

- National Security and Strategic Reserves: Countries with significant gold reserves may limit private ownership to safeguard their strategic resources and ensure national security.

A Global Snapshot of Gold Ownership Regulations:

While no universal limits exist, it’s essential to explore the specific regulations of different countries:

United States:

- No Limits: The United States does not impose any legal limits on the amount of gold an individual can own.

- Reporting Requirements: Transactions exceeding a certain threshold may trigger reporting requirements under anti-money laundering regulations.

- Storage Considerations: Individuals are free to store gold domestically or internationally, but they must comply with regulations regarding storage and transportation.

European Union:

- EU-Wide Regulations: The European Union does not have a uniform policy on gold ownership, with individual member states establishing their own regulations.

- Anti-Money Laundering Regulations: EU-wide anti-money laundering regulations apply to gold transactions, requiring reporting and due diligence procedures.

China:

- Restrictions on Physical Gold: China imposes limits on the amount of physical gold individuals can hold, with specific thresholds varying depending on the province.

- Gold Investment Products: Investments in gold-backed ETFs and other financial products are generally unrestricted.

India:

- Restrictions on Physical Gold: India imposes restrictions on the amount of physical gold that can be imported or held.

- Gold Investment Products: Investment in gold-backed ETFs and sovereign gold bonds is generally encouraged.

Switzerland:

- No Limits: Switzerland, renowned for its banking secrecy and financial stability, does not impose any limits on gold ownership.

- Taxation: Gold ownership is subject to capital gains tax upon sale.

Australia:

- No Limits: Australia does not impose any specific limits on gold ownership.

- Anti-Money Laundering Regulations: Anti-money laundering regulations apply to gold transactions, requiring reporting of suspicious activities.

The Importance of Legal Compliance:

Individuals seeking to own gold should always prioritize compliance with the laws of their jurisdiction. This includes:

- Understanding Local Regulations: Thoroughly researching and understanding the specific regulations governing gold ownership in their country of residence.

- Reporting Requirements: Adhering to any reporting requirements related to gold purchases, sales, or storage.

- Tax Implications: Being aware of and complying with tax obligations related to gold ownership, including capital gains tax.

- Professional Advice: Seeking professional advice from legal and financial experts to ensure compliance and navigate complex regulations.

Benefits of Gold Ownership:

While legal frameworks surrounding gold ownership vary, its potential benefits remain compelling:

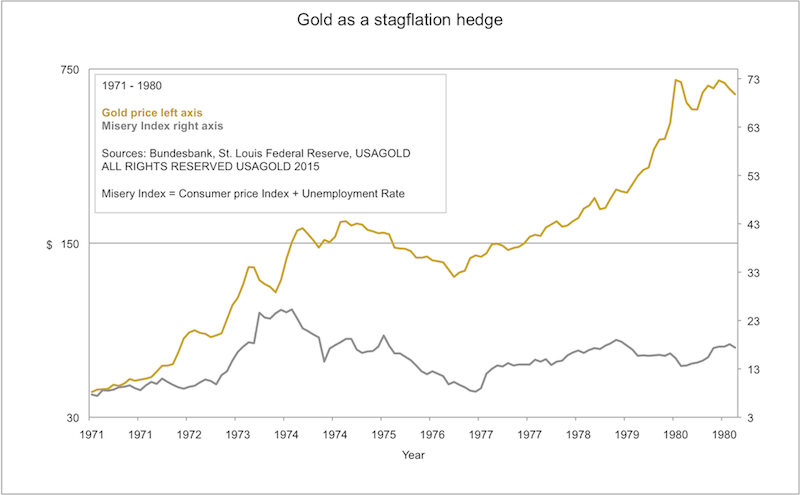

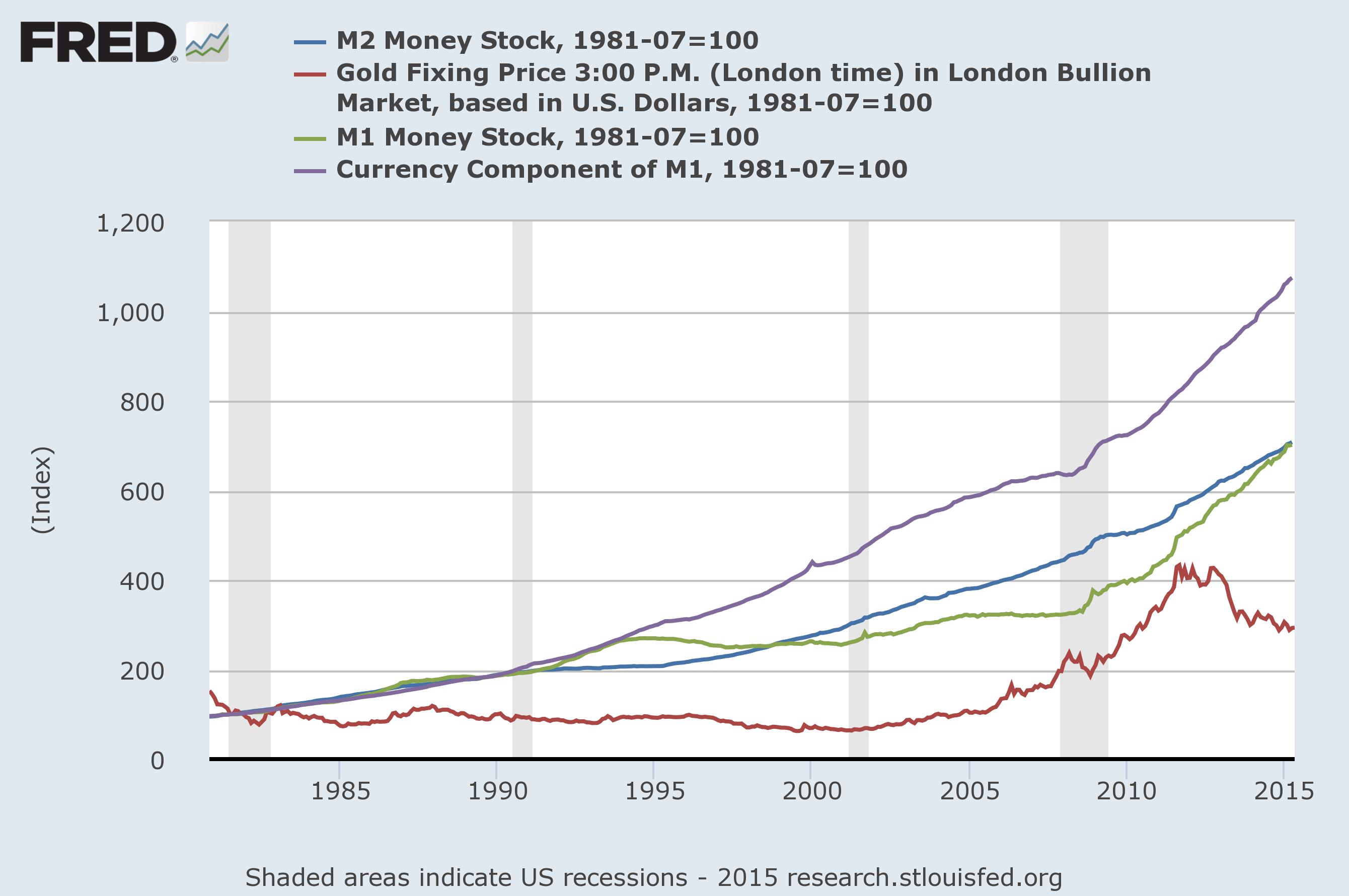

- Store of Value: Gold has historically maintained its value over long periods, serving as a hedge against inflation and currency devaluation.

- Safe Haven Asset: During economic uncertainty, gold often acts as a safe haven asset, providing a stable store of wealth amidst market volatility.

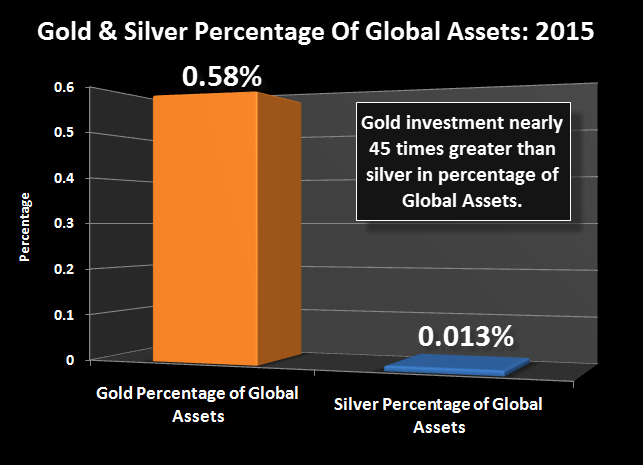

- Portfolio Diversification: Gold can diversify investment portfolios, reducing overall risk and enhancing returns.

- Physical Asset: Unlike digital assets, gold is a tangible asset that can be physically held and stored.

FAQs on Gold Ownership:

Q: Is it legal to own gold?

A: In most countries, owning gold is legal, but specific regulations and limits may apply.

Q: How much gold can I own?

A: The amount of gold an individual can own varies by country. Some countries impose limits, while others do not.

Q: What are the tax implications of owning gold?

A: Tax implications vary depending on the jurisdiction. Some countries may impose capital gains tax on gold sales.

Q: How do I store my gold safely?

A: Safe storage options include bank vaults, private safes, or specialized gold storage companies.

Q: Are there any reporting requirements for gold transactions?

A: Anti-money laundering regulations may require reporting of large or suspicious gold transactions.

Tips for Gold Ownership:

- Research and Understand Local Regulations: Thoroughly understand the laws and regulations governing gold ownership in your jurisdiction.

- Choose Reputable Dealers: Buy gold from reputable dealers to ensure its authenticity and quality.

- Diversify Your Holdings: Spread your gold investments across various forms, such as coins, bars, or ETFs.

- Secure Storage: Store your gold securely to protect it from theft or damage.

- Seek Professional Advice: Consult with legal and financial professionals to ensure compliance and optimize your gold ownership strategy.

Conclusion:

The legal framework surrounding gold ownership varies significantly across the globe. While no universal limits exist, individual countries implement regulations based on economic, security, and tax considerations. Understanding these regulations is crucial for individuals seeking to own gold, ensuring compliance and maximizing the potential benefits of this precious metal. Responsible gold ownership requires careful research, adherence to legal requirements, and a well-informed investment strategy.

Closure

Thus, we hope this article has provided valuable insights into The Limits of Gold Ownership: A Global Perspective. We hope you find this article informative and beneficial. See you in our next article!