The United States’ Gold Reserves: A Look at a Strategic Asset

Related Articles: The United States’ Gold Reserves: A Look at a Strategic Asset

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The United States’ Gold Reserves: A Look at a Strategic Asset. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The United States’ Gold Reserves: A Look at a Strategic Asset

The United States, a global economic powerhouse, holds a significant amount of gold in its reserves. This strategic asset, while not directly influencing the country’s monetary policy, plays a vital role in global financial stability and serves as a cornerstone of the nation’s economic security.

Understanding the U.S. Gold Holdings:

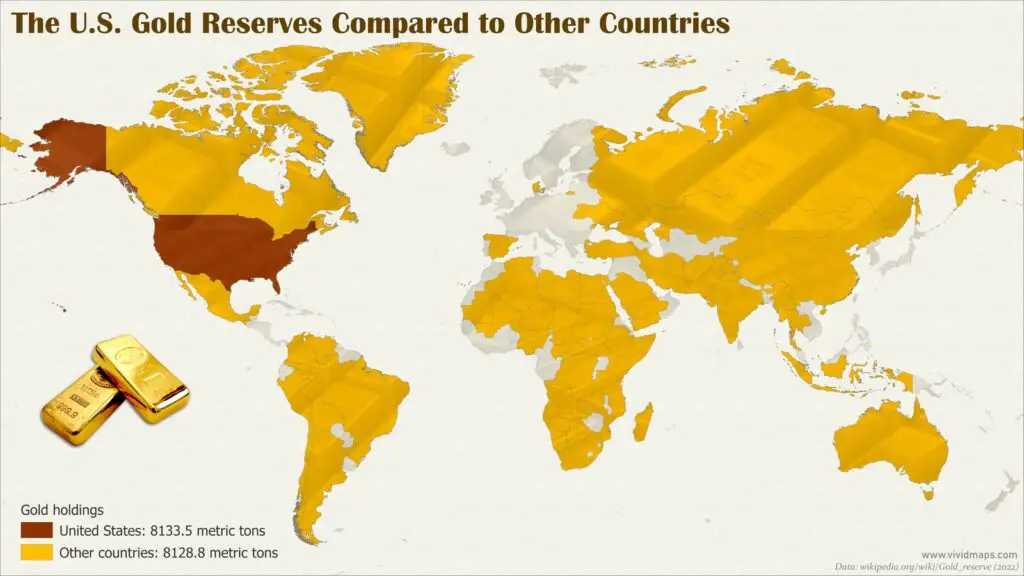

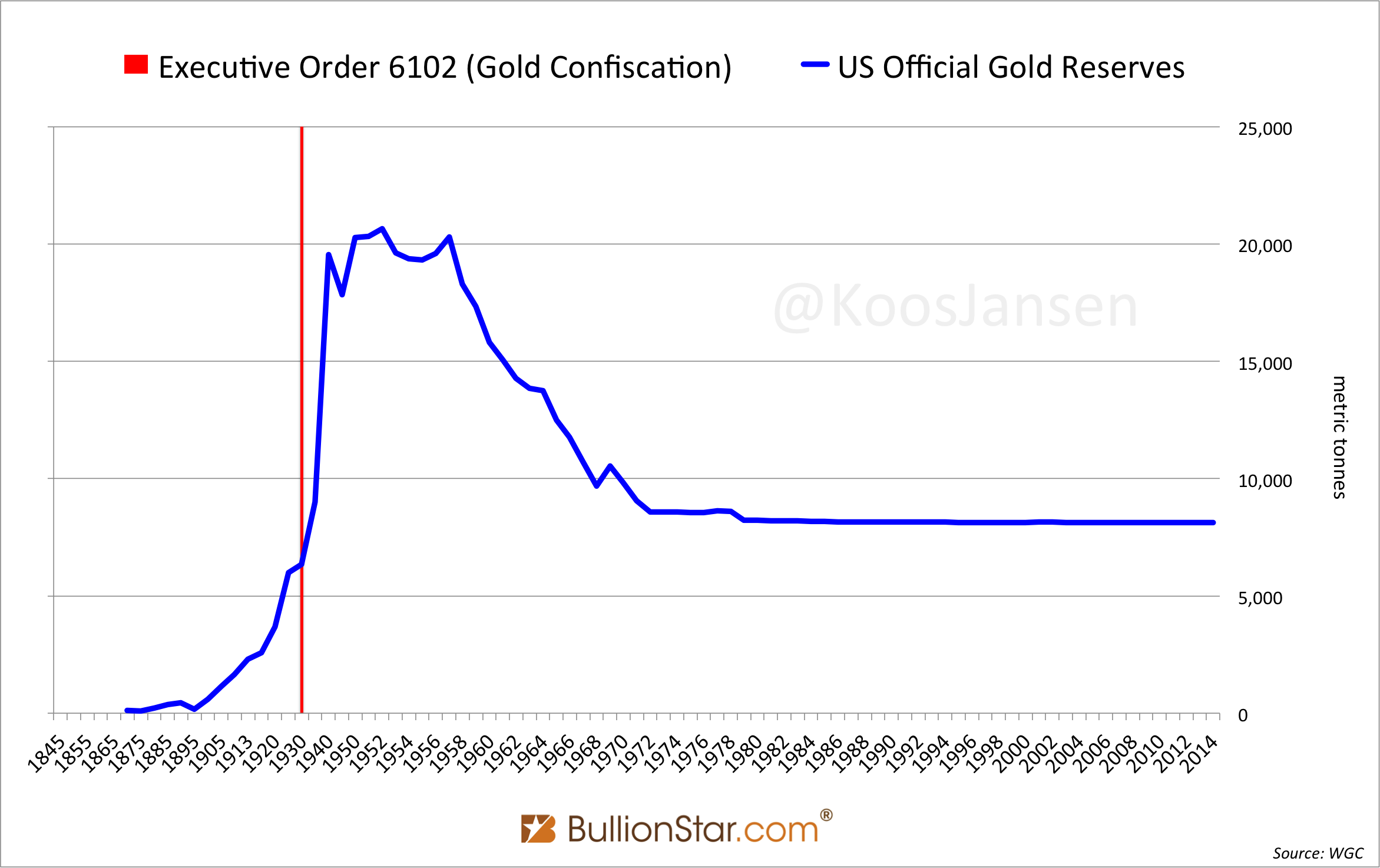

The United States holds the largest official gold reserves globally, surpassing even the holdings of the International Monetary Fund (IMF). As of October 2023, the U.S. Treasury’s official gold holdings stand at approximately 8,133.5 metric tons, valued at an estimated $480 billion. This vast stockpile is stored primarily at the U.S. Bullion Depository at Fort Knox, Kentucky, with a smaller portion held at the Federal Reserve Bank of New York.

The Historical Significance of U.S. Gold Reserves:

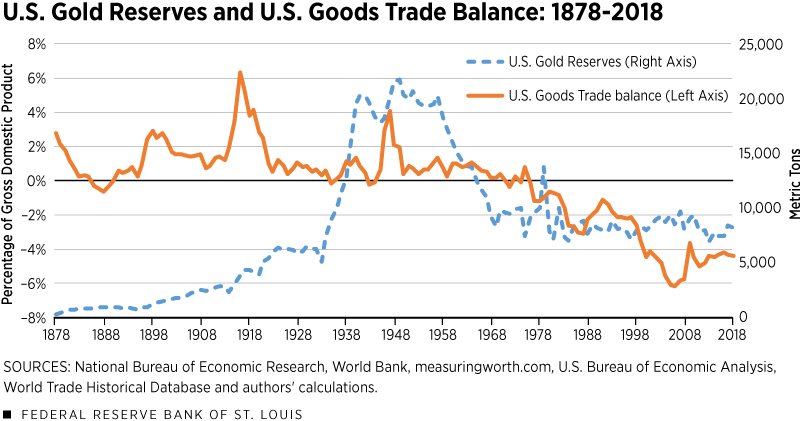

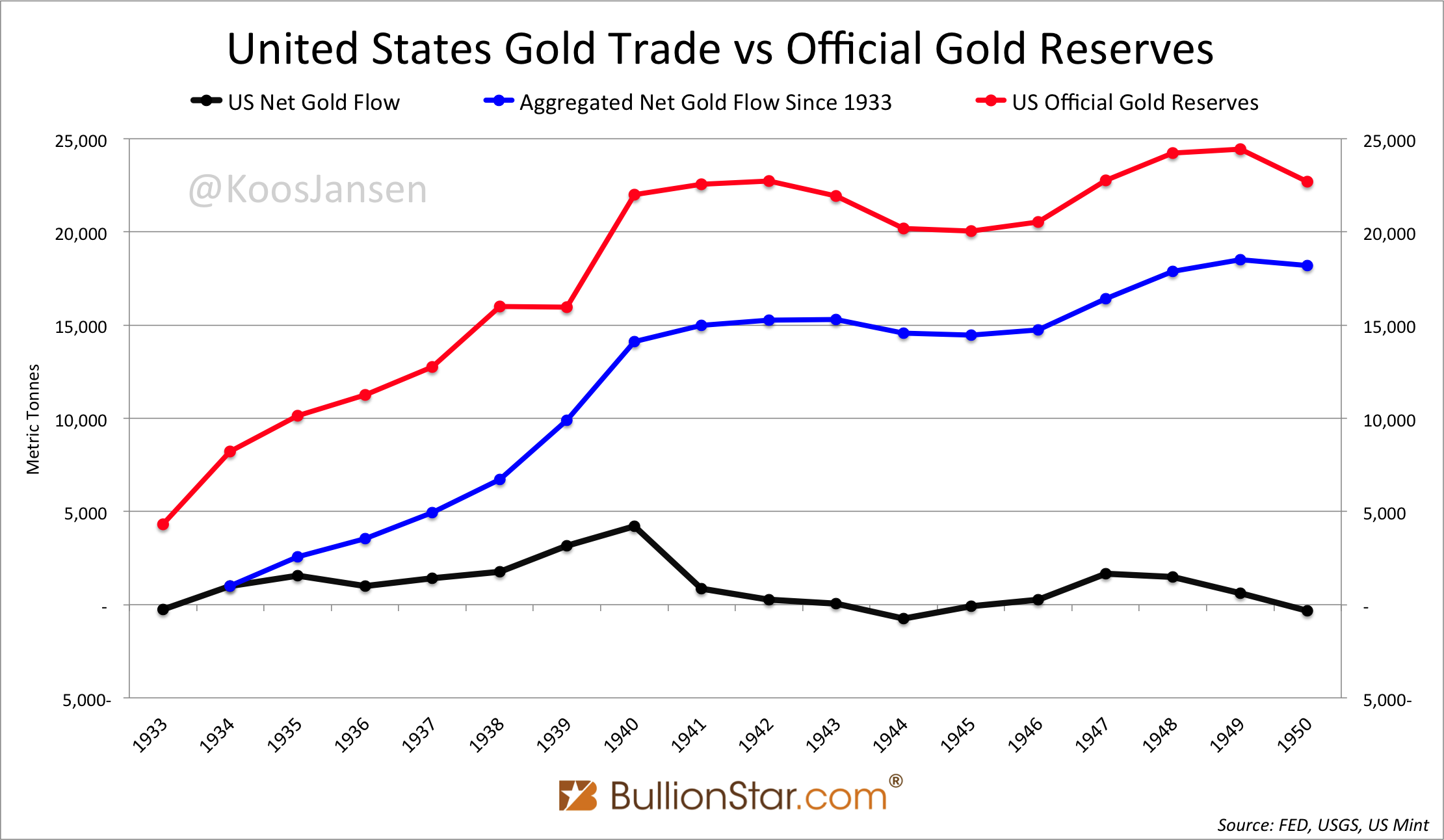

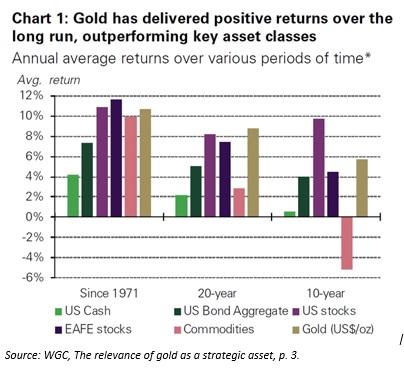

The United States’ gold holdings have a rich history, reflecting the country’s evolution as a global economic leader. During the Bretton Woods Agreement (1944-1971), gold served as the foundation of the international monetary system. The dollar’s value was pegged to gold, and other currencies were pegged to the dollar, creating a stable global financial order.

However, the system faced challenges, and in 1971, the United States abandoned the gold standard. This decision, while ending the direct link between gold and the dollar, did not diminish the importance of gold in the U.S. economy.

The Role of Gold in the U.S. Economy Today:

While no longer directly linked to the dollar, gold continues to play a significant role in the U.S. economy. Its importance can be understood through several key aspects:

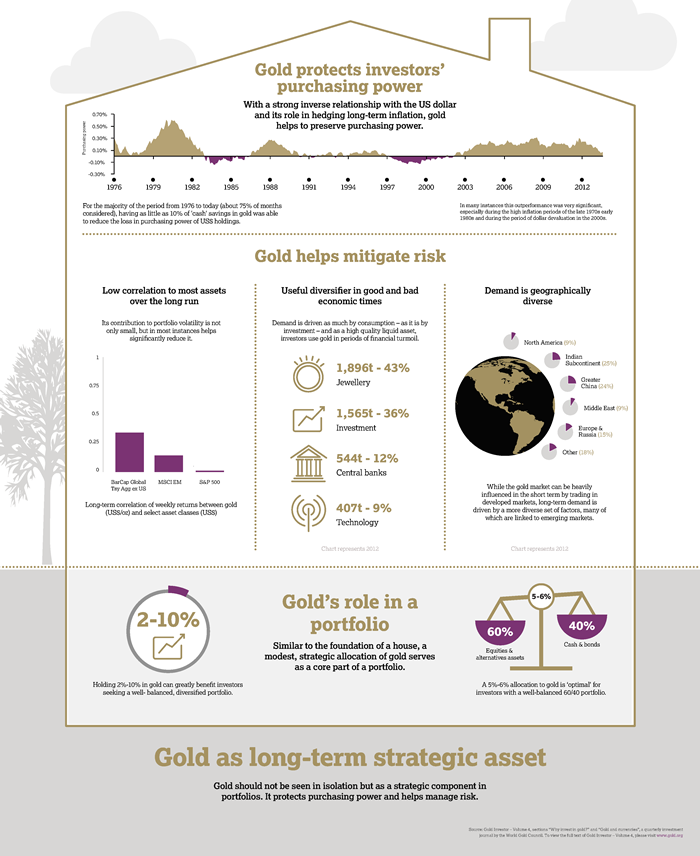

- Safe Haven Asset: During times of economic uncertainty or geopolitical instability, gold is often seen as a safe haven asset. Investors seek refuge in gold, believing its value will remain relatively stable or even increase during turbulent periods. This demand for gold can help bolster its price and provide a buffer against economic shocks.

- Global Currency Reserve: Although the U.S. dollar is the world’s dominant reserve currency, gold still serves as a global reserve asset. Countries hold gold as part of their foreign exchange reserves, contributing to the overall stability of the global financial system.

- Strategic Asset: Gold is considered a strategic asset for the United States, providing a form of insurance against economic or geopolitical risks. Its value can be accessed in times of need, offering a tangible asset that can be used to secure international transactions, fund government operations, or stabilize the economy.

- Economic Indicator: Fluctuations in the price of gold can provide insights into investor sentiment and economic conditions. A rising gold price can signal concerns about inflation, economic uncertainty, or geopolitical instability. Conversely, a declining gold price may indicate confidence in the economy and a perception of reduced risk.

The Future of U.S. Gold Reserves:

The future of U.S. gold reserves remains a topic of debate. Some argue that the United States should continue to hold a significant amount of gold, emphasizing its role as a safe haven asset and its strategic importance. Others advocate for reducing gold holdings, arguing that the metal is a non-productive asset and that the United States could invest the funds elsewhere.

The debate is likely to continue, as the role of gold in the global economy evolves. However, it is clear that the United States’ gold reserves remain a valuable asset, offering a degree of stability and security in a complex and interconnected world.

FAQs about U.S. Gold Holdings:

1. Where is the U.S. gold stored?

The majority of the U.S. gold reserves are stored at the U.S. Bullion Depository at Fort Knox, Kentucky. A smaller portion is held at the Federal Reserve Bank of New York.

2. Why does the U.S. hold so much gold?

The U.S. holds a significant amount of gold for several reasons:

- Safe Haven Asset: Gold provides a safe haven during times of economic uncertainty.

- Global Currency Reserve: Gold is a global reserve asset, contributing to the stability of the international financial system.

- Strategic Asset: Gold serves as a strategic asset, providing a form of insurance against economic or geopolitical risks.

3. Is the U.S. selling its gold?

The U.S. has not sold any gold in recent years. However, there have been discussions about potentially selling some gold to reduce the national debt or invest in other assets.

4. What is the impact of gold on the U.S. economy?

Gold’s impact on the U.S. economy is multifaceted:

- Safe Haven: Gold’s role as a safe haven asset can influence investor behavior during economic turmoil.

- Strategic Reserve: Gold provides a strategic reserve for the United States, offering a form of economic security.

- Economic Indicator: Gold price fluctuations can provide insights into investor sentiment and economic conditions.

5. How can I invest in gold?

There are several ways to invest in gold, including:

- Physical Gold: Purchasing gold coins or bars.

- Gold ETFs: Exchange-traded funds that track the price of gold.

- Gold Mining Stocks: Investing in companies that extract gold from the ground.

Tips for Understanding U.S. Gold Holdings:

- Follow Gold Price Trends: Pay attention to gold price movements, as they can reflect investor sentiment and economic conditions.

- Research Gold Investments: If you are considering investing in gold, thoroughly research the different options available.

- Stay Informed about U.S. Gold Policy: Monitor government announcements and policy changes related to U.S. gold reserves.

Conclusion:

The United States’ gold reserves are a testament to the nation’s economic strength and strategic planning. While the role of gold in the global economy has evolved, it remains a valuable asset, offering stability, security, and a sense of insurance against economic and geopolitical uncertainties. Understanding the significance of U.S. gold holdings provides valuable insights into the nation’s economic strategy and its role in the global financial system.

Closure

Thus, we hope this article has provided valuable insights into The United States’ Gold Reserves: A Look at a Strategic Asset. We thank you for taking the time to read this article. See you in our next article!