The Value of Pure Gold: A Comprehensive Guide to 24 Karat Gold

Related Articles: The Value of Pure Gold: A Comprehensive Guide to 24 Karat Gold

Introduction

With great pleasure, we will explore the intriguing topic related to The Value of Pure Gold: A Comprehensive Guide to 24 Karat Gold. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Value of Pure Gold: A Comprehensive Guide to 24 Karat Gold

Gold, a precious metal prized for its beauty, durability, and historical significance, has held a unique place in human civilization for millennia. Among its various forms, 24 karat gold stands out as the purest, representing the pinnacle of gold quality. Understanding the value of 24 karat gold requires delving into its characteristics, market forces, and practical applications.

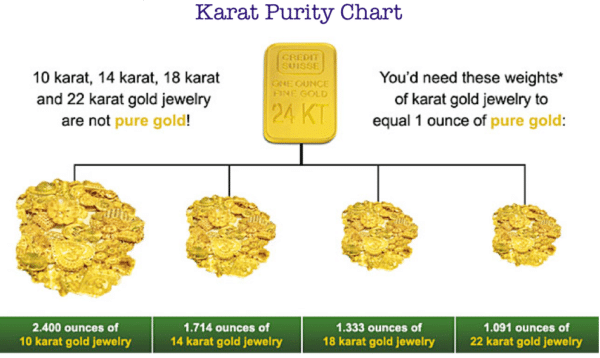

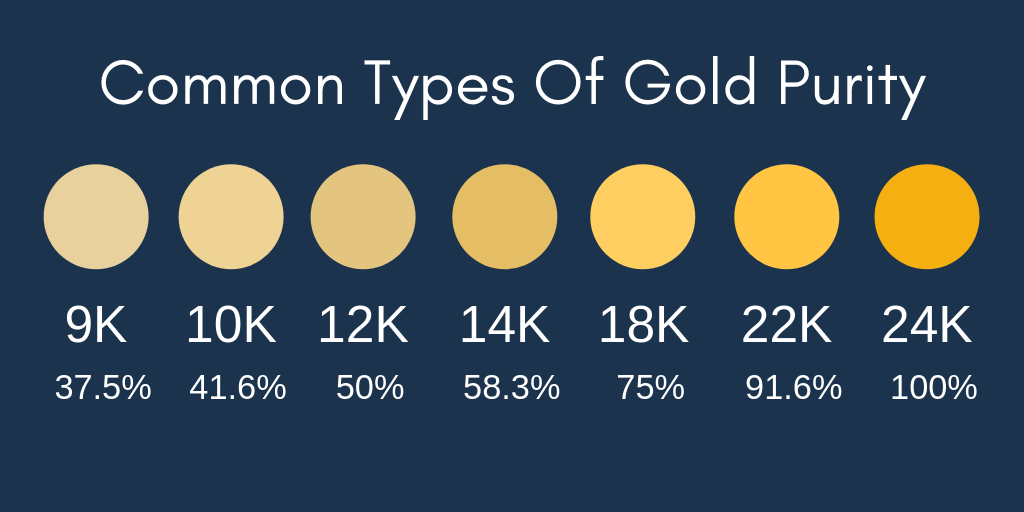

Purity and Karat System:

The karat system, used to measure the purity of gold, originates from the ancient world. A karat represents a 1/24th part of the whole. Therefore, 24 karat gold signifies pure gold, containing 100% gold, with no other metals mixed in. Lower karat gold, like 18 karat or 14 karat, signifies a mixture of gold with other metals, such as silver, copper, or nickel. These alloys are often used to create jewelry, enhance durability, or achieve specific colors.

Factors Influencing Gold Prices:

The price of gold fluctuates constantly, driven by a complex interplay of economic and geopolitical factors. Here are some key influencers:

- Supply and Demand: Like any commodity, gold’s price is influenced by the balance between supply and demand. Increased mining activity can lead to lower prices, while high demand, driven by factors like economic uncertainty or jewelry purchases, can push prices up.

- Inflation and Interest Rates: Gold is often seen as a hedge against inflation. When inflation rises, the purchasing power of fiat currencies decreases, making gold a more attractive investment. Conversely, rising interest rates can make holding gold less appealing, as investors may prefer higher returns from bonds or other interest-bearing assets.

- Economic Uncertainty: During times of global economic uncertainty, investors often turn to gold as a safe haven asset. Gold’s value tends to rise during such periods, as it is seen as a stable and liquid asset.

- Geopolitical Events: International events, such as wars, political instability, or sanctions, can also impact gold prices. In times of geopolitical turmoil, gold is often perceived as a safe haven, leading to increased demand and higher prices.

- Currency Exchange Rates: Fluctuations in exchange rates can influence the price of gold, as it is traded internationally. A weakening US dollar can make gold more expensive for buyers using other currencies.

Practical Applications of 24 Karat Gold:

While 24 karat gold’s purity makes it ideal for certain applications, its softness limits its use in everyday items. Here are some key areas where 24 karat gold finds application:

- Investment: Gold is a traditional investment asset, often used to diversify portfolios and protect against inflation. 24 karat gold bars and coins are popular choices for investors due to their high purity and recognition in international markets.

- Numismatics: 24 karat gold coins are highly valued by collectors and numismatists. These coins, often issued by governments or private mints, hold historical and artistic significance, making them sought-after collectibles.

- Jewelry: While less common for everyday jewelry, 24 karat gold is used for special occasions, creating exquisite and highly valued pieces. Its purity and brilliance make it a symbol of luxury and prestige.

- Electronics: 24 karat gold is used in electronics for its conductivity and resistance to corrosion. It is often found in connectors, contacts, and other components where reliable electrical performance is crucial.

- Medical Applications: 24 karat gold’s biocompatibility makes it suitable for use in medical implants, such as dental fillings, artificial joints, and pacemakers. Its inert nature minimizes the risk of allergic reactions and rejection by the body.

Understanding Gold Prices:

To get an accurate picture of 24 karat gold prices, it’s essential to consult reliable sources and understand the factors influencing them.

- Spot Prices: The spot price of gold refers to the current market price for immediate delivery. It is constantly updated based on supply and demand dynamics and can be accessed through reputable financial websites and news sources.

- Gold Bullion: Gold bullion refers to gold bars and coins of a specific weight and purity. Their price is determined by the spot price of gold, the weight of the bullion, and any premiums charged by dealers or mints.

- Jewelry Pricing: The price of 24 karat gold jewelry is influenced by the spot price, the weight of the gold, and the craftsmanship involved. Jewelry makers often add premiums to cover their labor, design, and marketing costs.

- Exchange-Traded Funds (ETFs): Gold ETFs provide investors with a convenient way to invest in gold without physically owning it. Their prices are based on the spot price of gold and the ETF’s specific investment strategy.

FAQs about 24 Karat Gold:

-

What is the difference between 24 karat and 18 karat gold?

- 24 karat gold is pure gold, containing 100% gold. 18 karat gold is an alloy containing 75% gold and 25% other metals.

-

Is 24 karat gold the best for jewelry?

- While 24 karat gold is highly valued for its purity, it is soft and prone to scratches. For everyday jewelry, 18 karat or 14 karat gold is often preferred for its durability.

-

How do I invest in 24 karat gold?

- You can invest in 24 karat gold by purchasing gold bullion, gold coins, or gold ETFs. Consult with a financial advisor to determine the best investment strategy for your needs.

-

Where can I find the current price of 24 karat gold?

- Reputable financial websites, news sources, and gold trading platforms provide updated spot prices for gold.

Tips for Buying and Selling 24 Karat Gold:

- Research: Thoroughly research reputable dealers, mints, and gold trading platforms before making any purchases.

- Verification: Ensure that the gold you purchase is certified and stamped with the correct karat marking.

- Storage: Store your gold in a secure and insured location.

- Professional Advice: Consult with a financial advisor or a reputable gold dealer for expert guidance on buying, selling, and storing gold.

Conclusion:

24 karat gold, representing the purest form of this precious metal, holds a unique position in the world of finance, jewelry, and technology. Its value is determined by a complex interplay of economic, geopolitical, and market forces. Understanding these factors, researching reputable sources, and seeking professional advice are crucial for navigating the world of 24 karat gold. Whether for investment, jewelry, or other applications, 24 karat gold continues to be a symbol of luxury, prestige, and enduring value.

Closure

Thus, we hope this article has provided valuable insights into The Value of Pure Gold: A Comprehensive Guide to 24 Karat Gold. We thank you for taking the time to read this article. See you in our next article!