The Value of Pure Gold: A Comprehensive Guide to 24 Karat

Related Articles: The Value of Pure Gold: A Comprehensive Guide to 24 Karat

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Value of Pure Gold: A Comprehensive Guide to 24 Karat. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Value of Pure Gold: A Comprehensive Guide to 24 Karat

Gold, a precious metal prized for its beauty, durability, and inherent value, has captivated humanity for millennia. Its allure transcends time, culture, and economic fluctuations, making it a consistent symbol of wealth and stability. While gold is available in various forms, 24 karat gold stands as the purest form, representing the pinnacle of gold’s quality.

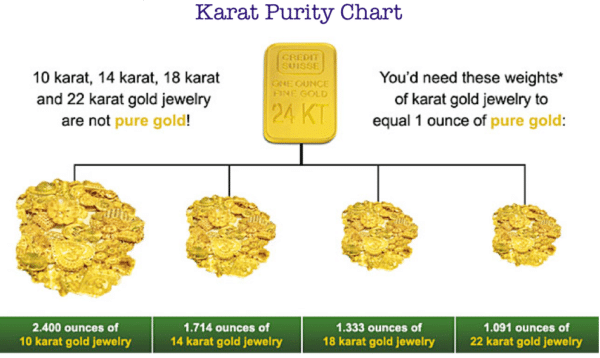

Understanding Karat and Purity

Karat, a unit of measurement for gold purity, signifies the proportion of pure gold within an alloy. 24 karat gold, often referred to as "pure gold," contains 100% pure gold, free from any other metals. This purity is the hallmark of 24 karat gold, making it exceptionally valuable and sought-after.

Factors Determining the Value of 24 Karat Gold

The value of 24 karat gold is not static; it fluctuates based on a complex interplay of economic and market forces. These key factors influence its price:

- Global Demand: The global demand for gold, driven by factors like investment, jewelry, and industrial applications, plays a significant role in its price. Increased demand typically leads to higher prices.

- Supply and Production: The availability of gold, influenced by mining production and recycling efforts, directly impacts its value. Reduced supply or increased production can affect price fluctuations.

- Economic Conditions: Global economic conditions, such as inflation, interest rates, and currency exchange rates, significantly influence gold’s value. In times of economic uncertainty, gold often serves as a safe-haven asset, leading to increased demand and higher prices.

- Geopolitical Events: Major geopolitical events, such as wars, political instability, and trade disputes, can impact the gold market. These events often trigger a flight to safety, leading to a rise in gold prices.

- Government Policies: Government policies, including regulations on gold mining and trading, can affect the supply and demand dynamics of gold, influencing its price.

- Investment Sentiment: Investor sentiment and market speculation play a crucial role in gold’s price. Positive sentiment and bullish market forecasts can drive up prices, while negative sentiment can lead to a decline.

How to Determine the Current Value of 24 Karat Gold

Several resources provide real-time information on the current price of 24 karat gold. These include:

- Reputable Financial Websites: Websites like Bloomberg, Reuters, and Kitco provide up-to-the-minute gold price data in various currencies.

- Gold Exchange-Traded Funds (ETFs): ETFs tracking gold prices, like SPDR Gold Shares (GLD), offer real-time pricing information.

- Gold Dealers and Refiners: Local gold dealers and refiners often provide current gold prices for their region.

- Online Gold Price Calculators: Numerous websites offer free online calculators that allow users to convert gold weight into its equivalent monetary value.

The Benefits of Investing in 24 Karat Gold

Investing in 24 karat gold offers several benefits:

- Hedge Against Inflation: Gold’s value tends to rise during periods of inflation, making it a valuable hedge against declining purchasing power.

- Safe-Haven Asset: In times of economic uncertainty and market volatility, gold serves as a safe-haven asset, providing a sense of security and stability to investors.

- Long-Term Value Preservation: Gold has historically maintained its value over long periods, making it a suitable asset for long-term wealth preservation.

- Diversification: Gold’s low correlation with other asset classes, such as stocks and bonds, makes it an excellent addition to a diversified investment portfolio.

FAQs about the Value of 24 Karat Gold

1. What is the difference between 24 karat and 18 karat gold?

While 24 karat gold represents pure gold, 18 karat gold contains 75% pure gold and 25% other metals. This alloying process makes 18 karat gold more durable and suitable for jewelry making.

2. Is 24 karat gold a good investment?

Whether 24 karat gold is a good investment depends on individual investment goals and risk tolerance. Its value is subject to market fluctuations, and it’s important to consider long-term trends and economic factors before making any investment decisions.

3. Can I buy 24 karat gold online?

Yes, numerous online platforms offer 24 karat gold for purchase, ranging from gold bullion coins and bars to jewelry. However, it’s crucial to choose reputable and secure online dealers.

4. How do I store my 24 karat gold safely?

Storing 24 karat gold safely is crucial. Options include home safes, bank safe deposit boxes, or specialized gold storage facilities.

5. What are the tax implications of investing in 24 karat gold?

Tax implications vary depending on individual circumstances and location. It’s advisable to consult with a financial advisor or tax professional for specific guidance.

Tips for Investing in 24 Karat Gold

- Conduct Thorough Research: Understand the factors influencing gold prices and the various investment options available.

- Set Clear Investment Goals: Determine your investment objectives, time horizon, and risk tolerance before investing.

- Choose Reputable Dealers: Select trusted and reliable gold dealers with a proven track record.

- Diversify Your Portfolio: Include gold as part of a diversified investment portfolio to mitigate risk.

- Monitor Gold Prices Regularly: Stay informed about gold market trends and adjust your investment strategy as needed.

Conclusion

24 karat gold, the purest form of gold, holds immense value driven by its rarity, durability, and historical significance. Its value is influenced by various factors, making it an asset with inherent volatility. While investing in 24 karat gold can offer benefits like inflation hedging, safe-haven status, and long-term value preservation, it’s crucial to approach investments with careful research, understanding of market dynamics, and a well-defined investment strategy. By understanding the factors influencing gold prices and making informed decisions, individuals can navigate the world of gold investment with confidence and potentially reap the rewards of this precious metal.

Closure

Thus, we hope this article has provided valuable insights into The Value of Pure Gold: A Comprehensive Guide to 24 Karat. We thank you for taking the time to read this article. See you in our next article!